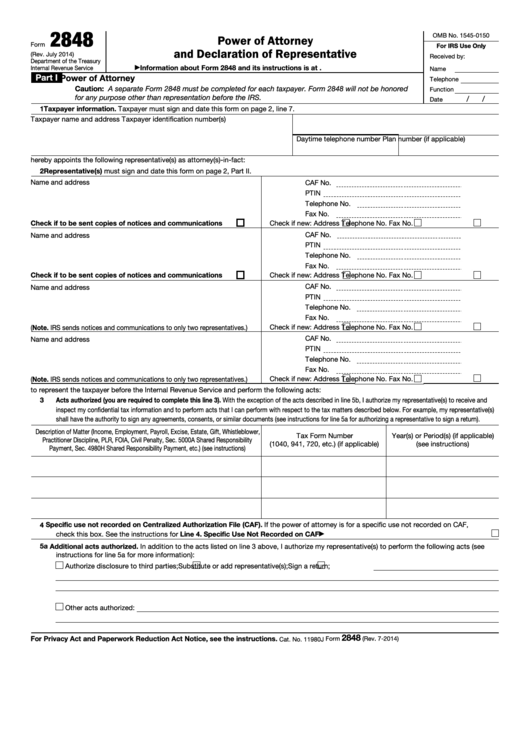

2848

OMB No. 1545-0150

Power of Attorney

Form

For IRS Use Only

and Declaration of Representative

(Rev. July 2014)

Received by:

Department of the Treasury

Information about Form 2848 and its instructions is at

Internal Revenue Service

Name

▶

Part I

Power of Attorney

Telephone

Caution: A separate Form 2848 must be completed for each taxpayer. Form 2848 will not be honored

Function

for any purpose other than representation before the IRS.

/

/

Date

1

Taxpayer information. Taxpayer must sign and date this form on page 2, line 7.

Taxpayer name and address

Taxpayer identification number(s)

Daytime telephone number

Plan number (if applicable)

hereby appoints the following representative(s) as attorney(s)-in-fact:

2

Representative(s) must sign and date this form on page 2, Part II.

Name and address

CAF No.

PTIN

Telephone No.

Fax No.

Check if to be sent copies of notices and communications

Check if new: Address

Telephone No.

Fax No.

CAF No.

Name and address

PTIN

Telephone No.

Fax No.

Check if to be sent copies of notices and communications

Check if new: Address

Telephone No.

Fax No.

CAF No.

Name and address

PTIN

Telephone No.

Fax No.

Check if new: Address

Telephone No.

Fax No.

(Note. IRS sends notices and communications to only two representatives.)

CAF No.

Name and address

PTIN

Telephone No.

Fax No.

Check if new: Address

Telephone No.

Fax No.

(Note. IRS sends notices and communications to only two representatives.)

to represent the taxpayer before the Internal Revenue Service and perform the following acts:

3

Acts authorized (you are required to complete this line 3). With the exception of the acts described in line 5b, I authorize my representative(s) to receive and

inspect my confidential tax information and to perform acts that I can perform with respect to the tax matters described below. For example, my representative(s)

shall have the authority to sign any agreements, consents, or similar documents (see instructions for line 5a for authorizing a representative to sign a return).

Description of Matter (Income, Employment, Payroll, Excise, Estate, Gift, Whistleblower,

Tax Form Number

Year(s) or Period(s) (if applicable)

Practitioner Discipline, PLR, FOIA, Civil Penalty, Sec. 5000A Shared Responsibility

(1040, 941, 720, etc.) (if applicable)

(see instructions)

Payment, Sec. 4980H Shared Responsibility Payment, etc.) (see instructions)

Specific use not recorded on Centralized Authorization File (CAF). If the power of attorney is for a specific use not recorded on CAF,

4

check this box. See the instructions for Line 4. Specific Use Not Recorded on CAF .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

5a

Additional acts authorized. In addition to the acts listed on line 3 above, I authorize my representative(s) to perform the following acts (see

instructions for line 5a for more information):

Authorize disclosure to third parties;

Substitute or add representative(s);

Sign a return;

Other acts authorized:

2848

For Privacy Act and Paperwork Reduction Act Notice, see the instructions.

Form

(Rev. 7-2014)

Cat. No. 11980J

1

1 2

2