Decedent's name

Decedent's social security number

Part 6 - General Information (continued)

Please check yes or no for each question. If you answer yes to any question 7- 15, you must attach additional information.

Yes

No

12.

Did the decedent ever possess, exercise or release any general power of appointment? If yes, you must complete

and attach Schedule H……………………………………………………………………………………………………………………………..

13.

Was the marital deduction computed under the transitional rule of Public Law 97-34, IRC section 403(e)(3) (Economic Recovery

Act of 1981)? If yes, attach a separate computation of the marital deduction, enter the amount on item 20 of the recapitulation,

and note on item 20 "Computation attached."……………………………………………………………………………………………………

14.

Was the decedent, immediately before death, receiving an annuity described in the "General" paragraph of the instructions

for Schedule I? If yes, you must complete and attach Schedule I…………………………………………………………………………….

15.

Was the decedent ever the beneficiary of a trust for which a deduction was claimed by the estate of a pre-deceased

spouse under IRC section 2056(b)(7) and which in not reported on this return? If yes, attach an explanation…………………………

Part 7 - Recapitulation

Alternate value

Value at date of death

Gross Estate

1.

Schedule A - Real estate…………………………………………………………

1.

2.

2.

Schedule B - Stock and bonds……………………………………………………

3.

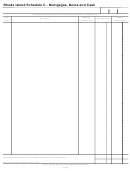

Schedule C - Mortgages, notes and cash………………………………………

3.

4.

4.

Schedule D - Insurance on the decedent's life…………………………………

5.

Schedule E - Jointly owned property……………………………………………

5.

6.

6.

Schedule F - Other miscellaneous property……………………………………

7.

Schedule G - Transfers during decedent's life…………………………………

7.

8.

8.

Schedule H - Powers of appointment……………………………………………

9.

Schedule I - Annuities……………………………………………………………

9.

10.

10.

Total gross estate. Add lines 1 through 9………………………………………

11.

11.

Schedule U - Qualified conservation easement exclusion……………………

12.

Total gross estate less exclusion. Subtract line 11 from line 10.

12.

Enter here and on page 1, part 2, line 1…………………………………………

Amount

Deductions

13.

13.

Schedule J - Funeral expenses and expenses incurred in administering property subject to claims…

14.

Schedule K - Debts of the decedent…………………………………………………………………………

14.

15.

15.

Schedule K - Mortgages and liens……………………………………………………………………………

16.

16.

Total. Add lines 13, 14 and 15………………………………………………………………………………

17.

17.

Allowable amount of deductions from line 16………………………………………………………………

18.

18.

Schedule L - Net losses during administration………………………………………………………………

19.

19.

Schedule L - Expenses incurred in administering property not subject to claims………………………

20.

20.

Schedule M - Bequests, etc., to surviving spouse…………………………………………………………

21.

21.

Schedule O - Charitable, public and similar gifts and bequests……………………………………………

22.

Schedule T - Qualified family-owned business interest deduction………………………………………

22.

23.

Total allowable deductions. Add lines 17 through 22. Enter here and on page 1, part 2, line 2………

23.

Page 3

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22