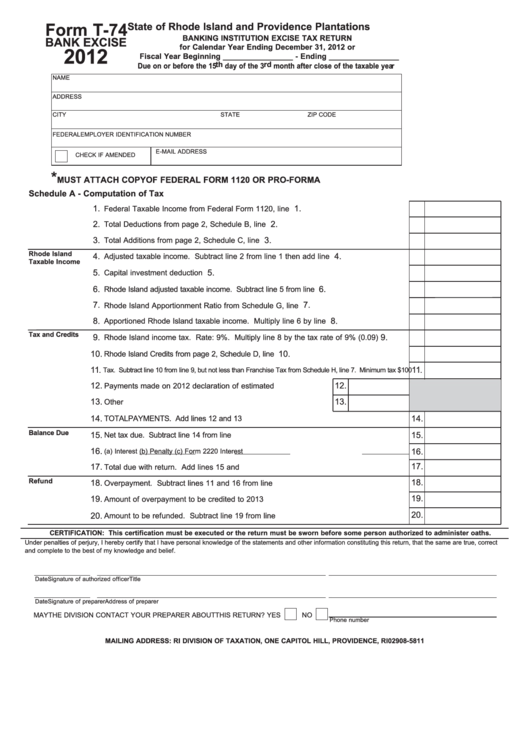

Form T-74 - Banking Institution Excise Tax Return - 2012

ADVERTISEMENT

State of Rhode Island and Providence Plantations

Form T-74

BANKING INSTITUTION EXCISE TAX RETURN

BANK EXCISE

for Calendar Year Ending December 31, 2012 or

2012

Fiscal Year Beginning ________________ - Ending ________________

Due on or before the 15 th day of the 3 rd month after close of the taxable year

NAME

ADDRESS

CITY

STATE

ZIP CODE

FEDERAL EMPLOYER IDENTIFICATION NUMBER

E-MAIL ADDRESS

CHECK IF AMENDED

*

MUST ATTACH COPY OF FEDERAL FORM 1120 OR PRO-FORMA

Schedule A - Computation of Tax

1.

1.

Federal Taxable Income from Federal Form 1120, line 28....................................................

2.

2.

Total Deductions from page 2, Schedule B, line 7.................................................................

3.

3.

Total Additions from page 2, Schedule C, line 6....................................................................

Rhode Island

4.

Adjusted taxable income. Subtract line 2 from line 1 then add line 3...................................

4.

Taxable Income

5.

Capital investment deduction ................................................................................................

5.

6.

6.

Rhode Island adjusted taxable income. Subtract line 5 from line 4............................................

7.

7.

Rhode Island Apportionment Ratio from Schedule G, line 5..................................................

8.

8.

Apportioned Rhode Island taxable income. Multiply line 6 by line 7....................................

Tax and Credits

9.

9.

Rhode Island income tax. Rate: 9%. Multiply line 8 by the tax rate of 9% (0.09)...............

10.

10.

Rhode Island Credits from page 2, Schedule D, line 7.................................................................

11.

11.

Tax. Subtract line 10 from line 9, but not less than Franchise Tax from Schedule H, line 7. Minimum tax $100

12.

12.

Payments made on 2012 declaration of estimated tax......................

13.

13.

Other payments..................................................................................

14.

14.

TOTAL PAYMENTS. Add lines 12 and 13 ...................................................................................

Balance Due

15.

15.

Net tax due. Subtract line 14 from line 11....................................................................................

16.

16.

(a) Interest

(b) Penalty

(c) Form 2220 Interest

17.

17.

Total due with return. Add lines 15 and 16............................................................................

Refund

18.

18.

Overpayment. Subtract lines 11 and 16 from line 14............................................................

19.

19.

Amount of overpayment to be credited to 2013 ....................................................................

20.

20.

Amount to be refunded. Subtract line 19 from line 18..........................................................

CERTIFICATION: This certification must be executed or the return must be sworn before some person authorized to administer oaths.

Under penalties of perjury, I hereby certify that I have personal knowledge of the statements and other information constituting this return, that the same are true, correct

and complete to the best of my knowledge and belief.

Date

Signature of authorized officer

Title

Date

Signature of preparer

Address of preparer

MAY THE DIVISION CONTACT YOUR PREPARER ABOUT THIS RETURN? YES

NO

Phone number

MAILING ADDRESS: RI DIVISION OF TAXATION, ONE CAPITOL HILL, PROVIDENCE, RI 02908-5811

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3