INSTRUCTIONS FOR FORM 401

GENERAL

This schedule is to be used in order to limit the amount of Alternative Minimum Assessment (AMA) paid by an affiliated

group. The amount of AMA is limited, so that the AMA liability when combined with the group’s Corporation Business

Tax liability will not exceed $20,000,000. A Key Corporation is a self-designated member of the affiliated group who

is responsible for reporting the liability for all members.

Enter the name, Federal Identification Number (FID), and Corporation Business Tax (CBT) Number of the Key

Corporation for the affiliated group. If the CBT plus the excess of the Alternative Minimum Assessment (AMA) over

the CBT for the entire affiliated group is less than the $20,000,000 threshold, then the Key Corporation will pay the

AMA for the entire group. If filing for an extension, the $20,000,000 payment should be remitted with the Key

Corporation’s Tentative Return (CBT-200-T). Form 401 must be filed with the Key Corporation’s CBT-100 tax return.

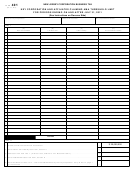

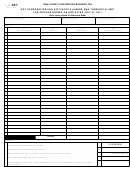

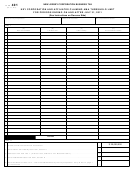

PART I

Enter the names of all the affiliated corporations in Column (A) and the Federal Identification Number (FID) in Column

(B). In Column (C), enter the amount of corporation business tax (CBT) as calculated on page 1, line 15 of the CBT-

100 packet for each affiliate including the minimum tax. Enter the AMA Excess (AMA less CBT) calculated for each

affiliate from Schedule AM, Part VII, line 5 in Column (D). The data for the Key Corporation should be reported

on line K.

At the bottom, enter the TOTAL CBT (Column C) and the TOTAL Excess AMA (Column D).

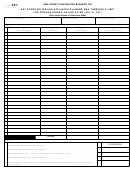

PART II

Line 1 - is the Maximum Alternative Minimum Assessment of $20,000,000.

Line 2 - enter the Total CBT Liability from Part I, Column (C).

Line 3 - subtract Line 2 from Line 1. If the result is zero or less, enter zero, there is no AMA liability.

Line 4 - enter the Total Excess AMA from Part I, Column (D).

Line 5 - enter the lesser of Line 3 or 4. This is the Total AMA due by the Key Corporation. Carry to Line 14, page 1

of the CBT-100.

1

1 2

2