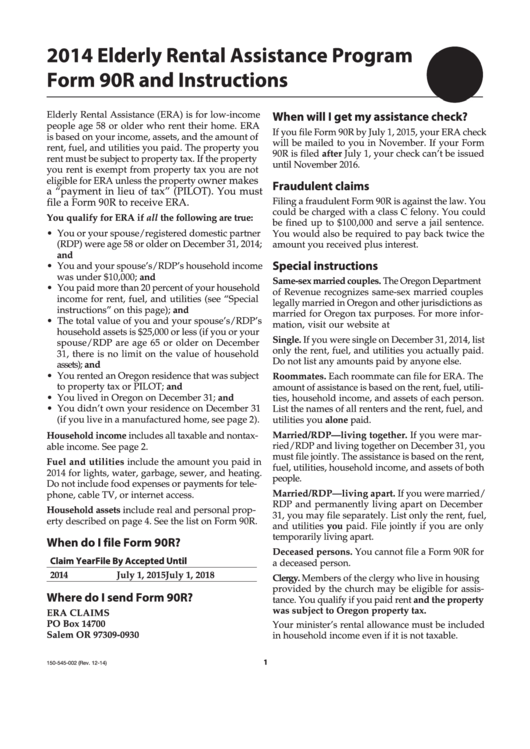

2014 Elderly Rental Assistance Program

ERA

Form 90R and Instructions

When will I get my assistance check?

Elderly Rental Assistance (ERA) is for low-income

people age 58 or older who rent their home. ERA

If you file Form 90R by July 1, 2015, your ERA check

is based on your income, assets, and the amount of

will be mailed to you in November. If your Form

rent, fuel, and utilities you paid. The property you

90R is filed after July 1, your check can’t be issued

rent must be subject to property tax. If the property

until November 2016.

you rent is exempt from property tax you are not

wner makes

eligible for ERA unless the property o

Fraudulent claims

a “payment in lieu of tax” (PILOT). You must

Filing a fraudulent Form 90R is against the law. You

file a Form 90R to receive ERA.

could be charged with a class C felony. You could

You qualify for ERA if all the following are true:

be fined up to $100,000 and serve a jail sentence.

• You or your spouse/registered domestic partner

You would also be required to pay back twice the

(RDP) were age 58 or older on December 31, 2014;

amount you received plus interest.

and

Special instructions

• You and your spouse’s/RDP’s household income

was under $10,000; and

Same‑sex married couples. The Oregon Department

• You paid more than 20 percent of your household

of Revenue recognizes same-sex married couples

income for rent, fuel, and utilities (see “Special

legally married in Oregon and other jurisdictions as

instructions” on this page); and

married for Oregon tax purposes. For more infor-

• The total value of you and your spouse’s/RDP’s

mation, visit our website at

household assets is $25,000 or less (if you or your

Single. If you were single on December 31, 2014, list

spouse/RDP are age 65 or older on December

only the rent, fuel, and utilities you actually paid.

31, there is no limit on the value of household

Do not list any amounts paid by anyone else.

assets); and

• You rented an Oregon residence that was subject

Roommates. Each roommate can file for ERA. The

to property tax or PILOT; and

amount of assistance is based on the rent, fuel, utili-

• You lived in Oregon on December 31; and

ties, household income, and assets of each person.

• You didn’t own your residence on December 31

List the names of all renters and the rent, fuel, and

(if you live in a manufactured home, see page 2).

utilities you alone paid.

Married/RDP—living together. If you were mar-

Household income includes all taxable and nontax-

ried/RDP and living together on December 31, you

able income. See page 2.

must file jointly. The assistance is based on the rent,

Fuel and utilities include the amount you paid in

fuel, utilities, household income, and assets of both

2014 for lights, water, garbage, sewer, and heating.

people.

Do not include food expenses or payments for tele-

Married/RDP—living apart. If you were married/

phone, cable TV, or internet access.

RDP and permanently living apart on December

Household assets include real and personal prop-

31, you may file separately. List only the rent, fuel,

erty described on page 4. See the list on Form 90R.

and utilities you paid. File jointly if you are only

temporarily living apart.

When do I file Form 90R?

Deceased persons. You cannot file a Form 90R for

Claim Year

File By

Accepted Until

a deceased person.

2014

July 1, 2015

July 1, 2018

Clergy. Members of the clergy who live in housing

provided by the church may be eligible for assis-

Where do I send Form 90R?

tance. You qualify if you paid rent and the property

was subject to Oregon property tax.

ERA CLAIMS

PO Box 14700

Your minister’s rental allowance must be included

Salem OR 97309‑0930

in household income even if it is not taxable.

1

150-545-002 (Rev. 12-14)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10