Reset Form

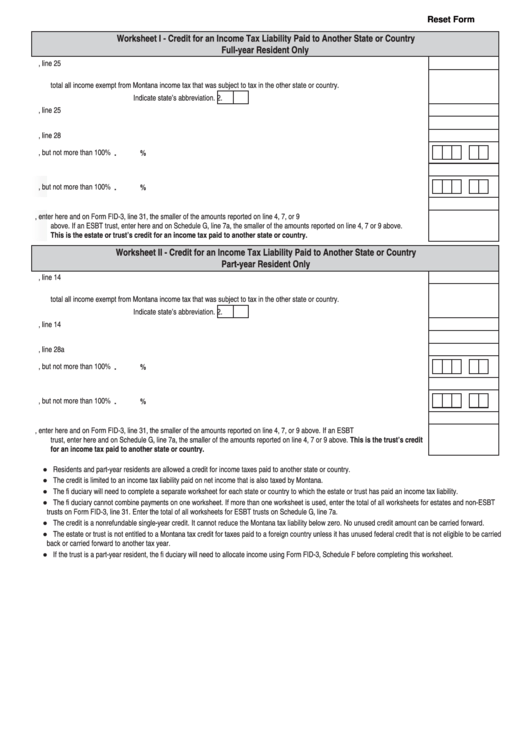

Worksheet I - Credit for an Income Tax Liability Paid to Another State or Country

Full-year Resident Only

1. Enter the income taxable to another state or country that is included in Montana income on Form FID-3, line 25 .............................. 1.

2. Enter the total income from the other state or country used in calculating the income tax paid to that state or country. Include in this

total all income exempt from Montana income tax that was subject to tax in the other state or country.

Indicate state’s abbreviation.

2.

3. Enter the total Montana income from Form FID-3, line 25 .................................................................................................................... 3.

4. Enter your total income tax liability paid to the other state or country ................................................................................................... 4.

5. Enter the Montana tax liability from Form FID-3, line 28 ....................................................................................................................... 5.

6. Divide line 1 by line 2. Enter the percentage here, but not more than 100% ........................................................................................ 6.

%

.

7. Multiply line 4 by line 6 and enter the result here .................................................................................................................................. 7.

8. Divide line 1 by line 3. Enter the percentage here, but not more than 100% ........................................................................................ 8.

%

.

9. Multiply line 5 by line 8 and enter the result here .................................................................................................................................. 9.

10. If an estate or non-ESBT trust, enter here and on Form FID-3, line 31, the smaller of the amounts reported on line 4, 7, or 9

above. If an ESBT trust, enter here and on Schedule G, line 7a, the smaller of the amounts reported on line 4, 7 or 9 above.

This is the estate or trust’s credit for an income tax paid to another state or country. ............................................................. 10.

Worksheet II - Credit for an Income Tax Liability Paid to Another State or Country

Part-year Resident Only

1. Enter the income taxable to another state or country that is included in Montana income on Schedule F, line 14 ............................... 1.

2. Enter the total income from the other state or country used in calculating the income tax paid to that state or country. Include in this

total all income exempt from Montana income tax that was subject to tax in the other state or country.

Indicate state’s abbreviation.

2.

3. Enter the total Montana income from Schedule F, line 14 ..................................................................................................................... 3.

4. Enter your total income tax liability paid to the other state or country ................................................................................................... 4.

5. Enter the Montana tax liability from Form FID-3, line 28a ..................................................................................................................... 5.

6. Divide line 1 by line 2. Enter the percentage here, but not more than 100% ........................................................................................ 6.

%

.

7. Multiply line 4 by line 6 and enter the result here .................................................................................................................................. 7.

8. Divide line 1 by line 3. Enter the percentage here, but not more than 100% ........................................................................................ 8.

%

.

9. Multiply line 5 by line 8 and enter the result here .................................................................................................................................. 9.

10. If a non-ESBT trust, enter here and on Form FID-3, line 31, the smaller of the amounts reported on line 4, 7, or 9 above. If an ESBT

trust, enter here and on Schedule G, line 7a, the smaller of the amounts reported on line 4, 7 or 9 above. This is the trust’s credit

for an income tax paid to another state or country. ....................................................................................................................... 10.

● Residents and part-year residents are allowed a credit for income taxes paid to another state or country.

● The credit is limited to an income tax liability paid on net income that is also taxed by Montana.

● The fi duciary will need to complete a separate worksheet for each state or country to which the estate or trust has paid an income tax liability.

● The fi duciary cannot combine payments on one worksheet. If more than one worksheet is used, enter the total of all worksheets for estates and non-ESBT

trusts on Form FID-3, line 31. Enter the total of all worksheets for ESBT trusts on Schedule G, line 7a.

● The credit is a nonrefundable single-year credit. It cannot reduce the Montana tax liability below zero. No unused credit amount can be carried forward.

● The estate or trust is not entitled to a Montana tax credit for taxes paid to a foreign country unless it has unused federal credit that is not eligible to be carried

back or carried forward to another tax year.

● If the trust is a part-year resident, the fi duciary will need to allocate income using Form FID-3, Schedule F before completing this worksheet.

1

1