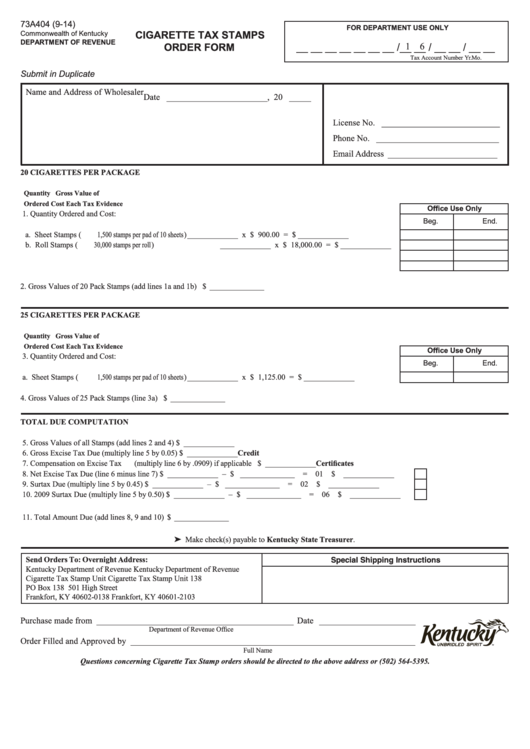

73A404 (9-14)

FOR DEPARTMENT USE ONLY

CIGARETTE TAX STAMPS

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

1 6

ORDER FORM

__ __ __ __ __ __ __ /__ __ / __ __ / __ __

Account Number

Tax

Mo.

Yr.

Submit in Duplicate

Name and Address of Wholesaler

Date _______________________ , 20 _____

License No. ___________________________

Phone No. ____________________________

Email Address _________________________

20 CIGARETTES PER PACKAGE

Quantity

Gross Value of

Ordered

Cost Each

Tax Evidence

Office Use Only

1. Quantity Ordered and Cost:

Beg.

End.

a. Sheet Stamps (1,500 stamps per pad of 10 sheets) _____________ x $

900.00

= $ _____________

b. Roll Stamps (30,000 stamps per roll)

_____________ x $

18,000.00

= $ _____________

2. Gross Values of 20 Pack Stamps (add lines 1a and 1b) ...................................................................................................................... $ ______________

25 CIGARETTES PER PACKAGE

Quantity

Gross Value of

Ordered

Cost Each

Tax Evidence

Office Use Only

3. Quantity Ordered and Cost:

Beg.

End.

a. Sheet Stamps (1,500 stamps per pad of 10 sheets) _____________ x $

1,125.00

= $ _____________

4. Gross Values of 25 Pack Stamps (line 3a) ............................................ .............................................................................................. $ ______________

TOTAL DUE COMPUTATION

5. Gross Values of all Stamps (add lines 2 and 4)

$ _____________

6. Gross Excise Tax Due (multiply line 5 by 0.05)

$ _____________

Credit

7. Compensation on Excise Tax (multiply line 6 by .0909) if applicable $ _____________

Certificates

8. Net Excise Tax Due (line 6 minus line 7)

$ _____________ – $ ______________

=

01

$ _____________

9. Surtax Due (multiply line 5 by 0.45)

$ _____________ – $ ______________

=

02

$ _____________

10. 2009 Surtax Due (multiply line 5 by 0.50)

$ _____________ – $ ______________

=

06

$ _____________

11. Total Amount Due (add lines 8, 9 and 10) .......................................................................................................................................... $ ______________

➤ Make check(s) payable to Kentucky State Treasurer.

Send Orders To:

Overnight Address:

Special Shipping Instructions

Kentucky Department of Revenue

Kentucky Department of Revenue

Cigarette Tax Stamp Unit

Cigarette Tax Stamp Unit 138

PO Box 138

501 High Street

Frankfort, KY 40602-0138

Frankfort, KY 40601-2103

Purchase made from _____________________________________________ Date ______________________

Department of Revenue Office

Order Filled and Approved by _________________________________________________________________

Full Name

Questions concerning Cigarette Tax Stamp orders should be directed to the above address or (502) 564-5395.

1

1