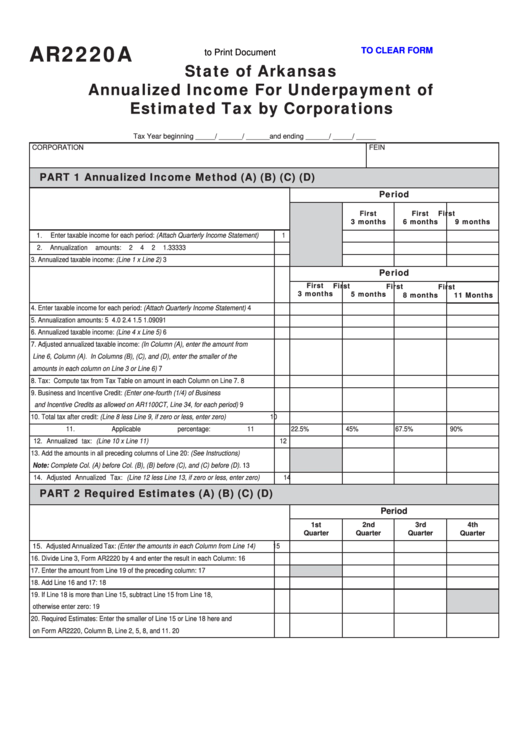

AR2220A

CLICK HERE TO CLEAR FORM

Click Here to Print Document

State of Arkansas

Annualized Income For Underpayment of

Estimated Tax by Corporations

Tax Year beginning _____ / ______ / ______ and ending ______ / _____ / _____

CORPORATION

FEIN

PART 1

Annualized Income Method

(A)

(B)

(C)

(D)

Period

First

First

First

3 months

6 months

9 months

1.

Enter taxable income for each period: (Attach Quarterly Income Statement)

1

2.

Annualization amounts:

2

4

2

1.33333

3.

Annualized taxable income: (Line 1 x Line 2)

3

Period

First

First

First

First

3 months

5 months

8 months

11 Months

4.

Enter taxable income for each period: (Attach Quarterly Income Statement)

4

5.

Annualization amounts:

5

4.0

2.4

1.5

1.09091

6.

Annualized taxable income: (Line 4 x Line 5)

6

7.

Adjusted annualized taxable income: (In Column (A), enter the amount from

Line 6, Column (A). In Columns (B), (C), and (D), enter the smaller of the

amounts in each column on Line 3 or Line 6)

7

8.

Tax: Compute tax from Tax Table on amount in each Column on Line 7.

8

9.

Business and Incentive Credit: (Enter one-fourth (1/4) of Business

and Incentive Credits as allowed on AR1100CT, Line 34, for each period)

9

10.

Total tax after credit: (Line 8 less Line 9, if zero or less, enter zero)

10

11.

Applicable percentage:

11

22.5%

45%

67.5%

90%

12.

Annualized tax: (Line 10 x Line 11)

12

13.

Add the amounts in all preceding columns of Line 20: (See Instructions)

Note: Complete Col. (A) before Col. (B), (B) before (C), and (C) before (D).

13

14.

Adjusted Annualized Tax: (Line 12 less Line 13, if zero or less, enter zero)

14

PART 2

Required Estimates

(A)

(B)

(C)

(D)

Period

1st

2nd

3rd

4th

Quarter

Quarter

Quarter

Quarter

15.

Adjusted Annualized Tax: (Enter the amounts in each Column from Line 14)

15

16.

Divide Line 3, Form AR2220 by 4 and enter the result in each Column:

16

17.

Enter the amount from Line 19 of the preceding column:

17

18.

Add Line 16 and 17:

18

19.

If Line 18 is more than Line 15, subtract Line 15 from Line 18,

otherwise enter zero:

19

20.

Required Estimates: Enter the smaller of Line 15 or Line 18 here and

on Form AR2220, Column B, Line 2, 5, 8, and 11.

20

1

1