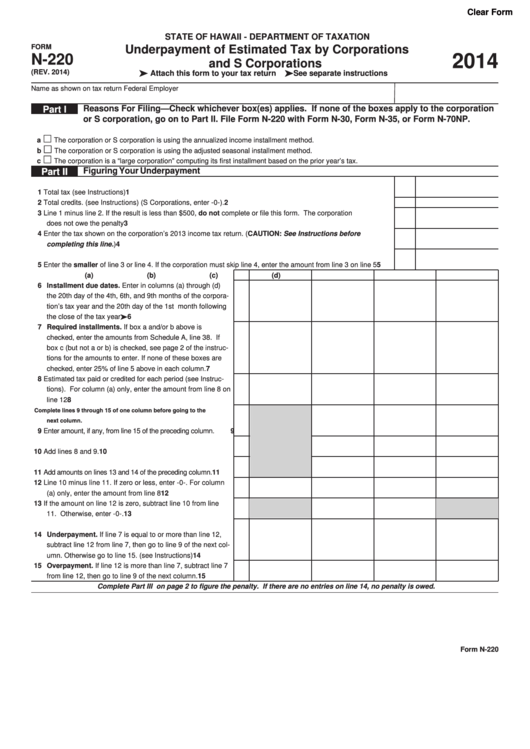

Clear Form

STATE OF HAWAII - DEPARTMENT OF TAXATION

Underpayment of Estimated Tax by Corporations

FORM

2014

N-220

and S Corporations

(REV. 2014)

Attach this form to your tax return

See separate instructions

Name as shown on tax return

Federal Employer I.D. Number

Part I

Reasons For Filing—Check whichever box(es) applies. If none of the boxes apply to the corporation

or S corporation, go on to Part II. File Form N-220 with Form N-30, Form N-35, or Form N-70NP.

a

The corporation or S corporation is using the annualized income installment method.

b

The corporation or S corporation is using the adjusted seasonal installment method.

c

The corporation is a “large corporation” computing its first installment based on the prior year’s tax.

Part II

Figuring Your Underpayment

1 Total tax (see Instructions) .......................................................................................................................................

1

2 Total credits. (see Instructions) (S Corporations, enter -0-). .....................................................................................

2

3 Line 1 minus line 2. If the result is less than $500, do not complete or file this form. The corporation

3

does not owe the penalty ..........................................................................................................................................

4 Enter the tax shown on the corporation’s 2013 income tax return. (CAUTION: See Instructions before

4

completing this line.) .............................................................................................................................................

5 Enter the smaller of line 3 or line 4. If the corporation must skip line 4, enter the amount from line 3 on line 5 ......

5

(a)

(b)

(c)

(d)

6 Installment due dates. Enter in columns (a) through (d)

the 20th day of the 4th, 6th, and 9th months of the corpora-

tion’s tax year and the 20th day of the 1st month following

6

the close of the tax year .................................................

7 Required installments. If box a and/or b above is

checked, enter the amounts from Schedule A, line 38. If

box c (but not a or b) is checked, see page 2 of the instruc-

tions for the amounts to enter. If none of these boxes are

7

checked, enter 25% of line 5 above in each column. .........

8 Estimated tax paid or credited for each period (see Instruc-

tions). For column (a) only, enter the amount from line 8 on

8

line 12 ................................................................................

Complete lines 9 through 15 of one column before going to the

next column.

9 Enter amount, if any, from line 15 of the preceding column. ....

9

10 Add lines 8 and 9. ..............................................................

10

11 Add amounts on lines 13 and 14 of the preceding column. ....

11

12 Line 10 minus line 11. If zero or less, enter -0-. For column

12

(a) only, enter the amount from line 8 ................................

13 If the amount on line 12 is zero, subtract line 10 from line

13

11. Otherwise, enter -0-. ...................................................

14 Underpayment. If line 7 is equal to or more than line 12,

subtract line 12 from line 7, then go to line 9 of the next col-

14

umn. Otherwise go to line 15. (see Instructions) ...............

15 Overpayment. If line 12 is more than line 7, subtract line 7

15

from line 12, then go to line 9 of the next column. .............

Complete Part III on page 2 to figure the penalty. If there are no entries on line 14, no penalty is owed.

Form N-220

1

1 2

2 3

3 4

4