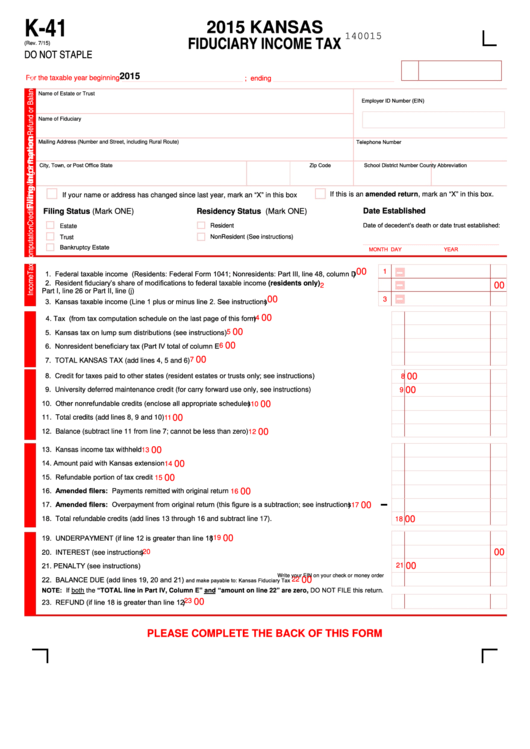

K-41

2015 KANSAS

FIDUCIARY INCOME TAX

140015

(Rev. 7/15)

DO NOT STAPLE

2 0 1 5

For the taxable year beginning

_______________________________

; ending

_______________________________

Name of Estate or Trust

Employer ID Number (EIN)

Name of Fiduciary

Telephone Number

Mailing Address (Number and Street, including Rural Route)

City, Town, or Post Office

State

Zip Code

School District Number

County Abbreviation

If this is an amended return, mark an “X” in this box.

If your name or address has changed since last year, mark an “X” in this box

Filing Status (Mark ONE)

Residency Status (Mark ONE)

Date Established

Date of decedent’s death or date trust established:

Resident

Estate

NonResident (See instructions)

Trust

_______________________________

Bankruptcy Estate

MONTH

DAY

YEAR

00

1

1. Federal taxable income (Residents: Federal Form 1041; Nonresidents: Part III, line 48, column D

).........

2. Resident fiduciary’s share of modifications to federal taxable income (residents only)

00

2

Part I, line 26 or Part II, line (j) ....................................................................................................................

00

3

3. Kansas taxable income (Line 1 plus or minus line 2. See instructions

).......................................................

4. Tax (from tax computation schedule on the last page of this form

) ..................................................................

00

4

5. Kansas tax on lump sum distributions (see instructions)

00

5

..................................................................................

6. Nonresident beneficiary tax (Part IV total of column E

00

6

.....................................................................................

00

7

7. TOTAL KANSAS TAX (add lines 4, 5 and 6)

....................................................................................................

8. Credit for taxes paid to other states (resident estates or trusts only; see instructions)

00

....................................

8

00

9. University deferred maintenance credit (for carry forward use only, see instructions)

.....................................

9

10. Other nonrefundable credits (enclose all appropriate schedules

) ....................................................................

00

10

00

11. Total credits (add lines 8, 9 and 10)

..................................................................................................................

11

00

12. Balance (subtract line 11 from line 7; cannot be less than zero)

......................................................................

12

00

13. Kansas income tax withheld

..............................................................................................................................

13

14. Amount paid with Kansas extension

00

..................................................................................................................

14

15. Refundable portion of tax credit

00

.......................................................................................................................

15

16. Amended filers: Payments remitted with original return

00

................................................................................

16

17. Amended filers: Overpayment from original return (this figure is a subtraction; see instructions

) ............

00

17

00

18. Total refundable credits (add lines 13 through 16 and subtract line 17) .

...........................................................

18

19. UNDERPAYMENT (if line 12 is greater than line 18

).........................................................................................

00

19

00

20

20. INTEREST (see instructions

) ............................................................................................................................

21. PENALTY (see instructions)

00

21

..............................................................................................................................

Write your EIN on your check or money order

22. BALANCE DUE (add lines 19, 20 and 21)

00

22

and make payable to: Kansas Fiduciary Tax

.............................................

NOTE: If both the “TOTAL line in Part IV, Column E” and “amount on line 22” are zero, DO NOT FILE this return.

23. REFUND (if line 18 is greater than line 12

) .......................................................................................................

23

00

PLEASE COMPLETE THE BACK OF THIS FORM

1

1 2

2 3

3 4

4