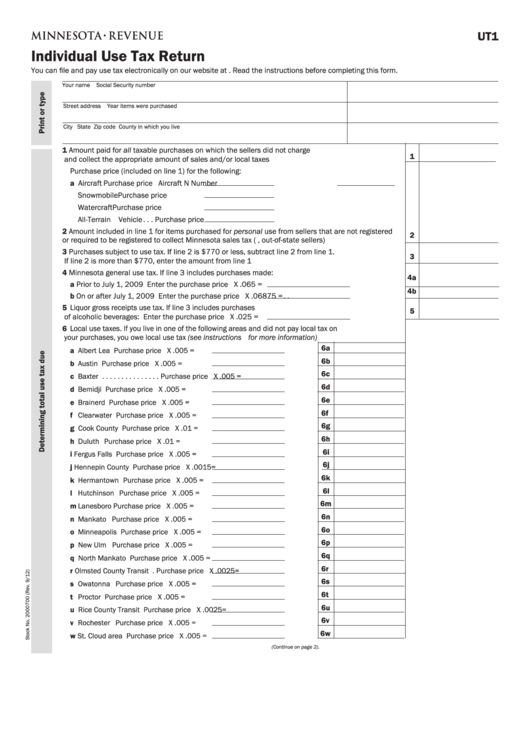

UT1

Individual Use Tax Return

You can file and pay use tax electronically on our website at . Read the instructions before completing this form .

Your name

Social Security number

Street address

Year items were purchased

City

State

Zip code

County in which you live

1 Amount paid for all taxable purchases on which the sellers did not charge

1

and collect the appropriate amount of sales and/or local taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Purchase price (included on line 1) for the following:

a Aircraft . . . . . . . . . . . . Purchase price

Aircraft N Number

Snowmobile . . . . . . . . Purchase price

Watercraft . . . . . . . . . Purchase price

All-Terrain Vehicle . . . Purchase price

2 Amount included in line 1 for items purchased for personal use from sellers that are not registered

2

or required to be registered to collect Minnesota sales tax (e .g ., out-of-state sellers) . . . . . . . . . . . . . . .

3 Purchases subject to use tax . If line 2 is $770 or less, subtract line 2 from line 1 .

3

If line 2 is more than $770, enter the amount from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Minnesota general use tax . If line 3 includes purchases made:

4a

a Prior to July 1, 2009 . . . . . . . . Enter the purchase price

X .065 = . . . .

4b

b On or after July 1, 2009 . . . . . . Enter the purchase price

X .06875 = . .

5 Liquor gross receipts use tax . If line 3 includes purchases

5

of alcoholic beverages: . . . . . . . . Enter the purchase price

X .025 = . . . .

6 Local use taxes . If you live in one of the following areas and did not pay local tax on

your purchases, you owe local use tax (see instructions for more information)

6a

a Albert Lea . . . . . . . . . . . . Purchase price

X .005 =

6b

b Austin . . . . . . . . . . . . . . . Purchase price

X .005 =

6c

c Baxter . . . . . . . . . . . . . . . Purchase price

X .005 =

6d

d Bemidji . . . . . . . . . . . . . . Purchase price

X .005 =

6e

e Brainerd . . . . . . . . . . . . . Purchase price

X .005 =

6f

f Clearwater . . . . . . . . . . . Purchase price

X .005 =

6g

g Cook County . . . . . . . . . . Purchase price

X .01 =

6h

h Duluth . . . . . . . . . . . . . . . Purchase price

X .01 =

6i

i Fergus Falls . . . . . . . . . . Purchase price

X .005 =

6j

j Hennepin County . . . . . . Purchase price

X .0015=

6k

k Hermantown . . . . . . . . . . Purchase price

X .005 =

6l

l Hutchinson . . . . . . . . . . . Purchase price

X .005 =

6m

m Lanesboro . . . . . . . . . . . . Purchase price

X .005 =

6n

n Mankato . . . . . . . . . . . . . Purchase price

X .005 =

6o

o Minneapolis . . . . . . . . . . Purchase price

X .005 =

6p

p New Ulm . . . . . . . . . . . . . Purchase price

X .005 =

6q

q North Mankato . . . . . . . . Purchase price

X .005 =

6r

r Olmsted County Transit . Purchase price

X .0025=

6s

s Owatonna . . . . . . . . . . . . Purchase price

X .005 =

6t

t Proctor . . . . . . . . . . . . . . Purchase price

X .005 =

6u

u Rice County Transit . . . . Purchase price

X .0025=

6v

v Rochester . . . . . . . . . . . . Purchase price

X .005 =

6w

w St . Cloud area . . . . . . . . . Purchase price

X .005 =

(Continue on page 2).

1

1 2

2 3

3 4

4