Print Blank Form

Print

Clear

Page 4

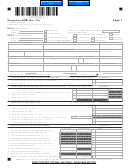

600S/2015

Georgia Form

(Corporation) Name

FEIN

COMPUTATION OF GEORGIA NET INCOME

(ROUND TO NEAREST DOLLAR)

SCHEDULE 9

1. Total Income for Georgia purposes (Line 11, Schedule 8) ...................................................................

1.

2. Income allocated everywhere (Must Attach Schedule) .......................................................................

2.

3. Business Income subject to apportionment (Line 1 less Line 2) .........................................................

3.

4. Georgia Ratio (Schedule 7, Column C) ..........................................................

4.

5. Net business income apportioned to Georgia (Line 3 x Line 4) ..........................................................

5.

6. Net income allocated to Georgia (Attach Schedule) ...........................................................................

6.

7. Total Georgia net income (Add Line 5 and Line 6) .............................................................................

7.

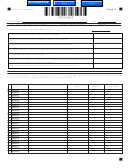

CREDIT USAGE AND CARRYOVER

(ROUND TO NEAREST DOLLAR)

SCHEDULE 10

1. Complete a separate schedule for each Credit Type Code.

2. Total the amounts on Line 12 of each schedule and enter the total on the credit line of the return.

3. See the tax booklet for a list of credit type codes.

4. See the relevant forms, statutes, and regulations to determine how the credit is allocated to the owners, to determine when carryovers expire, and to

see if the credit is limited to a certain percentage of tax.

5. If the credit for a particular credit code originated with more than one person or company, enter separate information on Lines 2 through 8 below.

6. The credit certificate number is issued for credits that are preapproved. If applicable, please enter the credit certificate number where indicated.

7. Before the Line 15 carryover is applied to the next year, the amount must be reduced by any amounts elected to be applied to withholding in 2015 and

by any carryovers that have expired.

For the credit generated this year, list the Company Name, ID number, Credit Certificate number, if applicable, and % of credit (purchased

credits and credits received from an assignment should also be included). If the credit originated with this taxpayer, enter this taxpayer’s

name and ID# below and 100% for the percentage.

1. Credit Type Code(Enter here and on Page 5)

SELECT

2. Company Name

ID Number

Credit Certificate #

% of Credit

Credit Generated in 2015

3. Company Name

ID Number

Credit Certificate #

Credit Generated in 2015

% of Credit

4. Company Name

ID Number

Credit Certificate #

% of Credit

Credit Generated in 2015

5. Company Name

ID Number

Credit Certificate #

% of Credit

Credit Generated in 2015

6. Company Name

ID Number

Credit Certificate #

Credit Generated in 2015

% of Credit

7. Company Name

ID Number

Credit Certificate #

% of Credit

Credit Generated in 2015

8. Company Name

ID Number

Credit Certificate #

Credit Generated in 2015

% of Credit

Additional Schedule 10

1

1 2

2 3

3 4

4 5

5 6

6