Form Ct-1120 Tic/ez - Connecticut Manufacturing Facility Tax Credit For Facilities Located In A Targeted Investment Community/enterprise Zone

ADVERTISEMENT

Department of Revenue Services

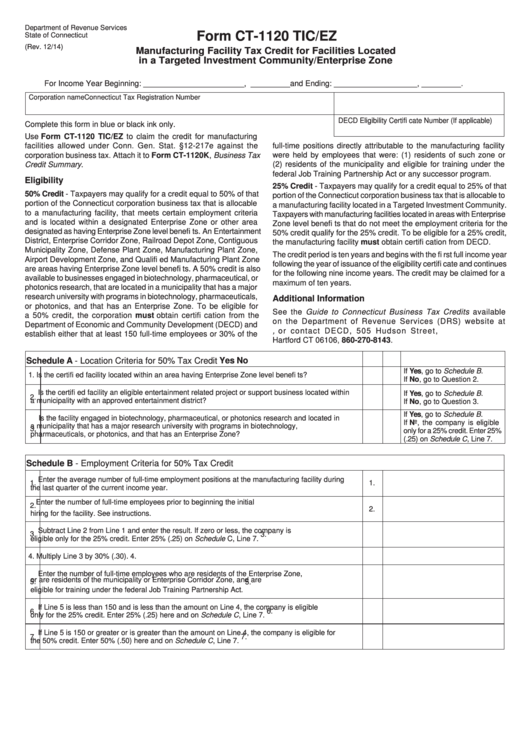

Form CT-1120 TIC/EZ

State of Connecticut

(Rev. 12/14)

Manufacturing Facility Tax Credit for Facilities Located

in a Targeted Investment Community/Enterprise Zone

For Income Year Beginning: _______________________ , _________ and Ending: ___________________ , _________ .

Corporation name

Connecticut Tax Registration Number

DECD Eligibility Certifi cate Number (If applicable)

Complete this form in blue or black ink only.

Use Form CT-1120 TIC/EZ to claim the credit for manufacturing

facilities allowed under Conn. Gen. Stat. §12-217e against the

full-time positions directly attributable to the manufacturing facility

were held by employees that were: (1) residents of such zone or

corporation business tax. Attach it to Form CT-1120K, Business Tax

(2) residents of the municipality and eligible for training under the

Credit Summary.

federal Job Training Partnership Act or any successor program.

Eligibility

25% Credit - Taxpayers may qualify for a credit equal to 25% of that

50% Credit - Taxpayers may qualify for a credit equal to 50% of that

portion of the Connecticut corporation business tax that is allocable to

portion of the Connecticut corporation business tax that is allocable

a manufacturing facility located in a Targeted Investment Community.

to a manufacturing facility, that meets certain employment criteria

Taxpayers with manufacturing facilities located in areas with Enterprise

and is located within a designated Enterprise Zone or other area

Zone level benefi ts that do not meet the employment criteria for the

designated as having Enterprise Zone level benefi ts. An Entertainment

50% credit qualify for the 25% credit. To be eligible for a 25% credit,

District, Enterprise Corridor Zone, Railroad Depot Zone, Contiguous

the manufacturing facility must obtain certifi cation from DECD.

Municipality Zone, Defense Plant Zone, Manufacturing Plant Zone,

The credit period is ten years and begins with the fi rst full income year

Airport Development Zone, and Qualifi ed Manufacturing Plant Zone

following the year of issuance of the eligibility certifi cate and continues

are areas having Enterprise Zone level benefi ts. A 50% credit is also

for the following nine income years. The credit may be claimed for a

available to businesses engaged in biotechnology, pharmaceutical, or

maximum of ten years.

photonics research, that are located in a municipality that has a major

research university with programs in biotechnology, pharmaceuticals,

Additional Information

or photonics, and that has an Enterprise Zone. To be eligible for

See the Guide to Connecticut Business Tax Credits available

a 50% credit, the corporation must obtain certifi cation from the

on the Department of Revenue Services (DRS) website at

Department of Economic and Community Development (DECD) and

, or contact DECD, 505 Hudson Street,

establish either that at least 150 full-time employees or 30% of the

Hartford CT 06106, 860-270-8143.

Schedule A - Location Criteria for 50% Tax Credit

Yes No

If Yes, go to Schedule B.

1.

Is the certifi ed facility located within an area having Enterprise Zone level benefi ts?

If No, go to Question 2.

Is the certifi ed facility an eligible entertainment related project or support business located within

If Yes, go to Schedule B.

2.

a municipality with an approved entertainment district?

If No, go to Question 3.

If Yes, go to Schedule B.

Is the facility engaged in biotechnology, pharmaceutical, or photonics research and located in

If No, the company is eligible

a municipality that has a major research university with programs in biotechnology,

3.

only for a 25% credit. Enter 25%

pharmaceuticals, or photonics, and that has an Enterprise Zone?

(.25) on Schedule C, Line 7.

Schedule B - Employment Criteria for 50% Tax Credit

Enter the average number of full-time employment positions at the manufacturing facility during

1.

1.

the last quarter of the current income year.

Enter the number of full-time employees prior to beginning the initial

2.

2.

hiring for the facility. See instructions.

Subtract Line 2 from Line 1 and enter the result. If zero or less, the company is

3.

3.

eligible only for the 25% credit. Enter 25% (.25) on Schedule C, Line 7.

4.

Multiply Line 3 by 30% (.30).

4.

Enter the number of full-time employees who are residents of the Enterprise Zone,

5.

or are residents of the municipality or Enterprise Corridor Zone, and are

5.

eligible for training under the federal Job Training Partnership Act.

If Line 5 is less than 150 and is less than the amount on Line 4, the company is eligible

6.

6.

only for the 25% credit. Enter 25% (.25) here and on Schedule C, Line 7.

If Line 5 is 150 or greater or is greater than the amount on Line 4, the company is eligible for

7.

7.

the 50% credit. Enter 50% (.50) here and on Schedule C, Line 7.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2