20

1299

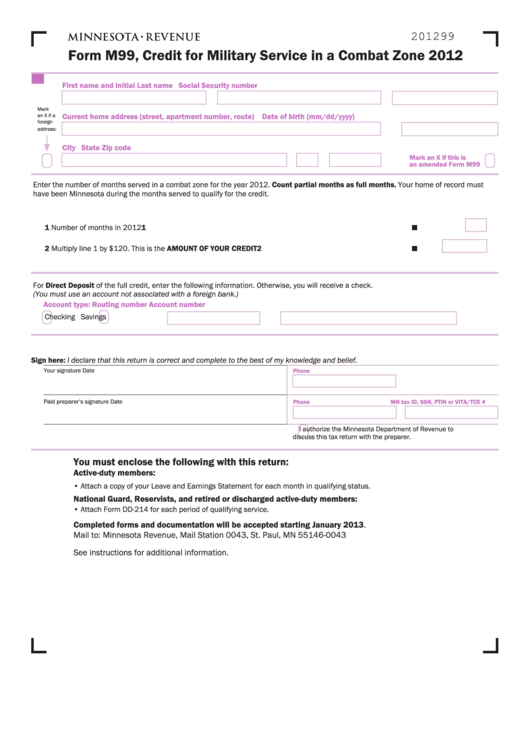

Form M99, Credit for Military Service in a Combat Zone 2012

First name and initial

Last name

Social Security number

Mark

Current home address (street, apartment number, route)

Date of birth (mm/dd/yyyy)

an X if a

foreign

address:

City

State

Zip code

Mark an X if this is

an amended Form M99

Enter the number of months served in a combat zone for the year 2012. Count partial months as full months. Your home of record must

have been Minnesota during the months served to qualify for the credit.

1 Number of months in 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1

2 Multiply line 1 by $120. This is the AMOUNT OF YOUR CREDIT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2

For Direct Deposit of the full credit, enter the following information. Otherwise, you will receive a check.

(You must use an account not associated with a foreign bank.)

Account type:

Routing number

Account number

Checking

Savings

Sign here: I declare that this return is correct and complete to the best of my knowledge and belief.

Your signature

Date

Phone

Paid preparer’s signature

Date

Phone

MN tax ID, SSN, PTIN or VITA/TCE #

I authorize the Minnesota Department of Revenue to

discuss this tax return with the preparer.

You must enclose the following with this return:

Active-duty members:

• Attach a copy of your Leave and Earnings Statement for each month in qualifying status.

National Guard, Reservists, and retired or discharged active-duty members:

• Attach Form DD-214 for each period of qualifying service.

Completed forms and documentation will be accepted starting January 2013.

Mail to: Minnesota Revenue, Mail Station 0043, St. Paul, MN 55146-0043

See instructions for additional information.

1

1 2

2 3

3