Form Rev-954 As - 3% Rate Table For Calculation Of The Motor Vehicle Lease Additional Tax

ADVERTISEMENT

REV-954 AS (12-05)

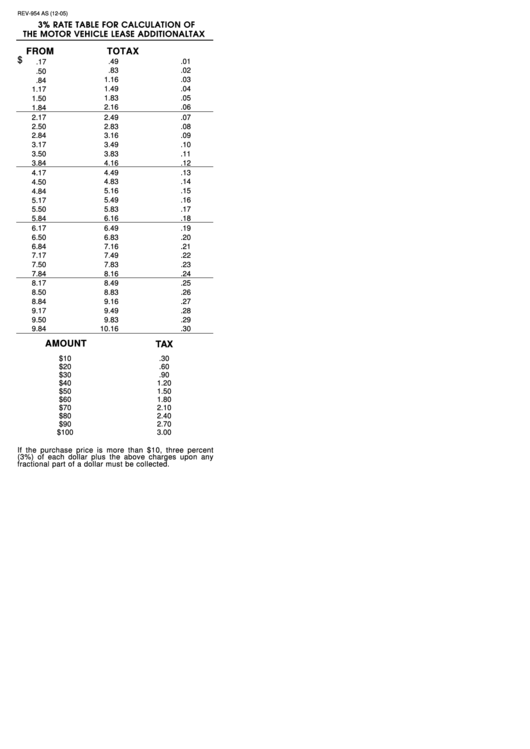

3% RATE TABLE FOR CALCULATION OF

THE MOTOR VEHICLE LEASE ADDITIONAL TAX

FROM

TO

TAX

$

.49

.01

.17

.83

.02

.50

1.16

.03

.84

1.49

.04

1.17

1.83

.05

1.50

2.16

.06

1.84

2.17

2.49

.07

2.50

2.83

.08

2.84

3.16

.09

3.17

3.49

.10

3.50

3.83

.11

3.84

4.16

.12

4.49

.13

4.17

4.83

.14

4.50

5.16

.15

4.84

5.49

.16

5.17

5.83

.17

5.50

6.16

.18

5.84

6.17

6.49

.19

6.50

6.83

.20

6.84

7.16

.21

7.17

7.49

.22

7.50

7.83

.23

7.84

8.16

.24

8.17

8.49

.25

8.50

8.83

.26

8.84

9.16

.27

9.17

9.49

.28

9.50

9.83

.29

9.84

10.16

.30

AMOUNT

TAX

$10

.30

$20

.60

$30

.90

$40

1.20

$50

1.50

$60

1.80

$70

2.10

$80

2.40

$90

2.70

$100

3.00

If the purchase price is more than $10, three percent

(3%) of each dollar plus the above charges upon any

fractional part of a dollar must be collected.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1