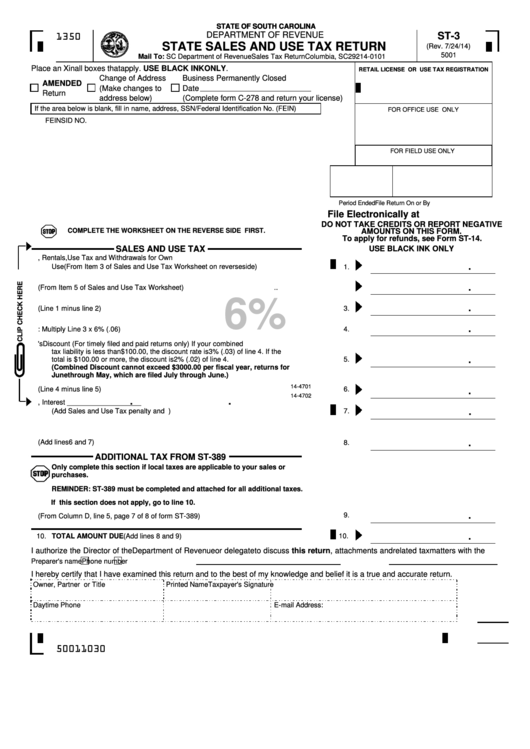

STATE OF SOUTH CAROLINA

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

ST-3

1350

STATE SALES AND USE TAX RETURN

(Rev. 7/24/14)

5001

Mail To: SC Department of Revenue

Sales Tax Return

Columbia, SC 29214-0101

Place an X in all boxes that apply. USE BLACK INK ONLY.

RETAIL LICENSE OR USE TAX REGISTRATION

Change of Address

Business Permanently Closed

AMENDED

(Make changes to

Date

Return

address below)

(Complete form C-278 and return your license)

If the area below is blank, fill in name, address, SSN/Federal Identification No. (FEIN)

FOR OFFICE USE ONLY

FEIN

SID NO.

FOR FIELD USE ONLY

Period Ended

File Return On or By

File Electronically at

DO NOT TAKE CREDITS OR REPORT NEGATIVE

COMPLETE THE WORKSHEET ON THE REVERSE SIDE FIRST.

AMOUNTS ON THIS FORM.

To apply for refunds, see Form ST-14.

SALES AND USE TAX

USE BLACK INK ONLY

1. Total Gross Proceeds of Sales, Rentals, Use Tax and Withdrawals for Own

.

Use (From Item 3 of Sales and Use Tax Worksheet on reverse side)

..................................

1.

.

2. Total Amount of Deductions (From Item 5 of Sales and Use Tax Worksheet)

..

............................... 2.

6%

.

3. Net Taxable Sales and Purchases (Line 1 minus line 2)

..............................................................

3.

.

4.

Tax: Multiply Line 3 x 6% (.06)

......................................................................................................

4.

5. Taxpayer's Discount (For timely filed and paid returns only) If your combined

tax liability is less than $100.00, the discount rate is 3% (.03) of line 4. If the

.

total is $100.00 or more, the discount is 2% (.02) of line 4.

..........................................................

5.

(Combined Discount cannot exceed $3000.00 per fiscal year, returns for

June through May, which are filed July through June.)

14-4701

6. Sales and Use Tax Net Amount Payable (Line 4 minus line 5)

.....................................................

6.

.

14-4702

.

.

7. Penalty _________________ , Interest ___________________

.

........................

(Add Sales and Use Tax penalty and interest. Enter total on line 7 at right.)

7.

.

8.

Total Sales and Use Tax Due (Add lines 6 and 7)

.........................................................................

8.

ADDITIONAL TAX FROM ST-389

Only complete this section if local taxes are applicable to your sales or

purchases.

REMINDER: ST-389 must be completed and attached for all additional taxes.

If this section does not apply, go to line 10.

.

9.

........................................

9.

Total Taxes Due (From Column D, line 5, page 7 of 8 of form ST-389)

.

10. TOTAL AMOUNT DUE (Add lines 8 and 9)

10.

........................................................................

I authorize the Director of the Department of Revenue or delegate to discuss this return, attachments and related tax matters with the

preparer.

Yes

No

Preparer's name

Phone number

I hereby certify that I have examined this return and to the best of my knowledge and belief it is a true and accurate return.

Taxpayer's Signature

Owner, Partner or Title

Printed Name

Daytime Phone No.

Date

E-mail Address:

50011030

1

1 2

2