Essential Information For Form St-3ez - State Sales And Use Tax Return

ADVERTISEMENT

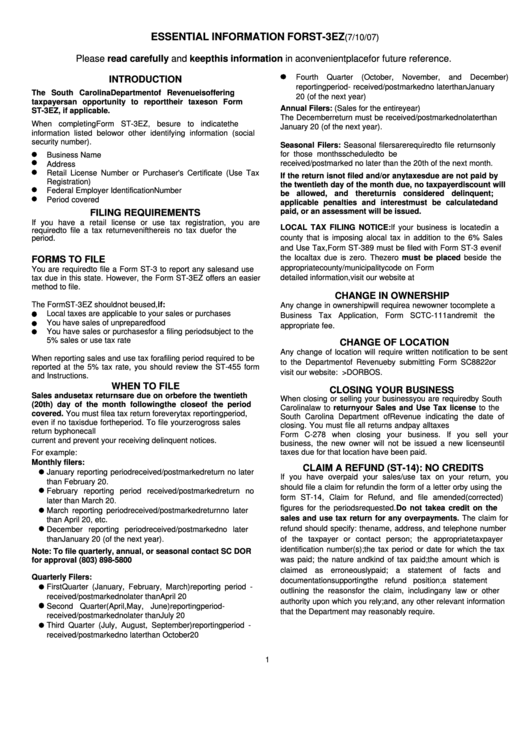

ESSENTIAL INFORMATION FOR ST-3EZ

(7/10/07)

Please read carefully and keep this information in a convenient place for future reference.

Fourth

Quarter

(October,

November,

and

December)

INTRODUCTION

reporting period - received/postmarked no later than January

The South Carolina Department of Revenue is offering

20 (of the next year)

taxpayers an opportunity to report their taxes on Form

Annual Filers: (Sales for the entire year)

ST-3EZ, if applicable.

The December return must be received/postmarked no later than

When completing Form ST-3EZ, be sure to indicate the

January 20 (of the next year).

information listed below or other identifying information (social

security number).

Seasonal Filers: Seasonal filers are required to file returns only

for those months scheduled to be reported. Returns must be

Business Name

received/postmarked no later than the 20th of the next month.

Address

Retail License Number or Purchaser's Certificate (Use Tax

If the return is not filed and/or any taxes due are not paid by

Registration)

the twentieth day of the month due, no taxpayer discount will

Federal Employer Identification Number

be allowed, and the return is considered delinquent;

Period covered

applicable penalties and interest must be calculated and

paid, or an assessment will be issued.

FILING REQUIREMENTS

If you have a retail license or use tax registration, you are

LOCAL TAX FILING NOTICE: If your business is located in a

required to file a tax return even if there is no tax due for the

period.

county that is imposing a local tax in addition to the 6% Sales

and Use Tax, Form ST-389 must be filed with Form ST-3 even if

the local tax due is zero. The zero must be placed beside the

FORMS TO FILE

appropriate county/municipality code on Form ST-389. For more

You are required to file a Form ST-3 to report any sales and use

tax due in this state. However, the Form ST-3EZ offers an easier

detailed information, visit our website at

method to file.

CHANGE IN OWNERSHIP

The Form ST-3EZ should not be used, if:

Any change in ownership will require a new owner to complete a

Local taxes are applicable to your sales or purchases

Business Tax Application, Form SCTC-111 and remit the

You have sales of unprepared food

appropriate fee.

You have sales or purchases for a filing period subject to the

5% sales or use tax rate

CHANGE OF LOCATION

Any change of location will require written notification to be sent

When reporting sales and use tax for a filing period required to be

to the Department of Revenue by submitting Form SC8822 or

reported at the 5% tax rate, you should review the ST-455 form

visit our website: >DORBOS.

and Instructions.

WHEN TO FILE

CLOSING YOUR BUSINESS

Sales and use tax returns are due on or before the twentieth

When closing or selling your business you are required by South

(20th) day of the month following the close of the period

Carolina law to return your Sales and Use Tax license to the

covered. You must file a tax return for every tax reporting period,

South Carolina Department of Revenue indicating the date of

even if no tax is due for the period. To file your zero gross sales

closing. You must file all returns and pay all taxes due. Complete

return by phone call 1-803-898-5918. This will keep your account

Form C-278 when closing your business. If you sell your

current and prevent your receiving delinquent notices.

business, the new owner will not be issued a new license until

taxes due for that location have been paid.

For example:

Monthly filers:

CLAIM A REFUND (ST-14): NO CREDITS

January reporting period received/postmarked return no later

If you have overpaid your sales/use tax on your return, you

than February 20.

should file a claim for refund in the form of a letter or by using the

February reporting period received/postmarked return no

form ST-14, Claim for Refund, and file amended (corrected)

later than March 20.

figures for the periods requested. Do not take a credit on the

March reporting period received/postmarked return no later

sales and use tax return for any overpayments. The claim for

than April 20, etc.

refund should specify: the name, address, and telephone number

December reporting period received/postmarked no later

than January 20 (of the next year).

of the taxpayer or contact person; the appropriate taxpayer

identification number(s); the tax period or date for which the tax

Note: To file quarterly, annual, or seasonal contact SC DOR

was paid; the nature and kind of tax paid; the amount which is

for approval (803) 898-5800

claimed as erroneously paid; a statement of facts and

Quarterly Filers:

documentation supporting the refund position; a statement

First Quarter (January, February, March) reporting period -

outlining the reasons for the claim, including any law or other

received/postmarked no later than April 20

authority upon which you rely; and, any other relevant information

Second Quarter (April, May, June) reporting period -

that the Department may reasonably require.

received/postmarked no later than July 20

Third Quarter (July, August, September) reporting period -

received/postmarked no later than October 20

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5