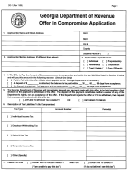

BOE-490 (S2F) REV. 1 (1-06)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

SECTION 3. OFFER AMOUNT

AMOUNT OWED TO THE BOARD OF EQUALIZATION

PERIOD(S) OF LIABILITY

BOE ACCOUNT NUMBER(S)

The sum of $

is offered in compromise. (The Board will instruct you when to mail the

offer amount. Do not send money now.)

It is understood that this offer will be considered and acted upon as quickly as possible. It does not relieve the

taxpayer(s) of the liability sought to be compromised until the Board accepts the offer and there has been full

compliance with all agreements. The Board may continue collection activities at its discretion.

Except for any amount deposited in connection with this offer, it is agreed that the Board will retain all payments

and credits made to the account for the periods covered by this offer. In addition, prior to the offer being accepted,

the Board will retain any and all amounts to which the taxpayer(s) may be entitled under the California law, due

through overpayments of tax, penalty or interest, not to exceed the liability.

It is further agreed that upon notice to the taxpayer(s) of the acceptance of the offer, the taxpayer(s) shall have no

right to contest, in court or otherwise, the amount of the liability sought to be compromised. No liability will be

compromised until all obligations of each taxpayer under the compromise agreement are completely performed. In

the event of a default by the taxpayer(s) on the agreement, it is agreed that the Board may disregard the amount of

the offer and retain all amounts previously deposited under the offer and proceed to collect the balance of the

original liability.

Under penalty of perjury, I declare that I have examined the information given in this statement, and all other

documents included with this offer, and to the best of my knowledge and belief, they are true, correct, and

complete.

APPLICANT (please pr nt)

i

CO-APPLICANT (please print)

DATE

APPLICANT (signature)

CO-APPLICANT (signature)

DATE

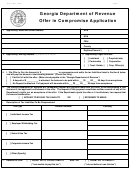

PROCESSING ACCEPTED OFFERS

Recommendations to accept offers for sales and use taxes, underground storage fuel tax, and use fuel tax where

the compromise is less than $7,500 in tax will be forwarded to the Board’s Legal Division and the Executive

Director for a decision. Recommendations to accept offers where the compromise is more than $7,500 in tax will be

forwarded to the Legal Department, Executive Director, and to the Board Members for a decision to be determined

at a Board meeting. Recommendations to accept offers for all other tax and fee programs are handled by the

Attorney General’s Office (there are fees associated with the legal filing of the offer and you may be contacted for

these fees).

PROCESSING DENIED OFFERS

If we reject or deny the offer, we will refund any deposit already obtained or apply it to the liability at the request of

the taxpayer with an effective date as the date the funds were received. No interest will be granted on returned

deposits. If a third party has posted the deposited amount, staff must get written permission from the third party to

apply the deposit. The case will be returned to the district with a recommendation for case handling.

There is no formal appeal process for rejected or denied offers in compromise.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11