Instructions For Arizona Form 120w - Estimated Tax Worksheet For Corporations - 2015 Page 3

ADVERTISEMENT

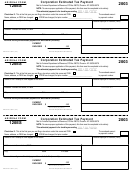

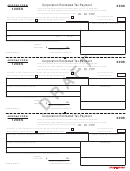

Arizona Form 120W

Line 8 - Nonrefundable Tax Credits

Part I - Annualized Income Installment Method

Enter the total amount of nonrefundable tax credits to which the

Line 1 - Annualization Periods

taxpayer is entitled because of events that occurred during the

Enter the annualization period that the taxpayer is using in the

months shown in the column headings used to calculate

space on line 1, columns (a) through (d), respectively.

annualized taxable income. Calculate this amount using the

instructions for 2014 Form 99T, line 9; or 2014 Form 120,

Forms 120, 120A, and 120S

line 19; or 2014 Form 120A, line 11; or 2014 Form 120S,

line 15.

1st

2nd

3rd

4th

Option

Installment

Installment

Installment

Installment

Line 10 - Refundable Tax Credits

Enter the total amount of refundable tax credits to which the

Standard option

3

3

6

9

taxpayer is entitled because of events that occurred during the

months shown in the column headings used to calculate

Option 1

2

4

7

10

annualized taxable income. Calculate this amount using the

instructions for 2014 Form 99T, line 12; or 2014 Form 120,

Option 2

3

5

8

11

line 22; or 2014 Form 120A, line 14; or 2014 Form 120S,

line 18.

Form 99T

Line 11 - Claim of Right Adjustment (Forms 120

1st

2nd

3rd

4th

and 120A)

Option

Installment

Installment

Installment

Installment

A taxpayer that computes its tax liability under the claim of

Standard option

2

3

6

9

right provisions should base its estimated tax liability on the

net tax liability computed under the claim of right provisions.

Option 1

2

4

7

10

Line 15 - Cumulative Installments

Line 3 - Annualization Amounts

Complete column (a) before completing columns (b)

through (d). Before completing line 15 in columns (b)

Enter the annualization amounts for the option used on line 1.

through (d), complete the following items in each of the

Forms 120, 120A, and 120S

preceding columns: line 16; Part II (if applicable); and Part III.

EXAMPLE: Complete line 16, Part II (if using the adjusted

1st

2nd

3rd

4th

Option

Installment

Installment

Installment

Installment

seasonal installment method), and Part III, in column (a)

before completing line 15 in column (b).

Standard option

4

4

2

1.33333

Part II - Adjusted Seasonal Installment Method

Option 1

6

3

1.71429

1.2

Do not complete this part unless the taxpayer's base period

percentage for any six consecutive months of the taxable year

Option 2

4

2.4

1.5

1.09091

equals or exceeds 70 percent. The term "base period

percentage" for any period of six consecutive months is the

Form 99T

average of the three percentages calculated by dividing the

taxable income for the corresponding six consecutive month

1st

2nd

3rd

4th

Option

Installment

Installment

Installment

Installment

period in each of the three preceding taxable years by the

taxable income for each of their respective taxable years.

Standard option

6

4

2

1.33333

Line 26 - Calculate the Tax

Option 1

6

3

1.71429

1.2

nd

NOTE: Laws 2011, 2

Special Session, Chapter 1, Section 105,

lowers the corporate tax rate for tax year 2015 to 6.0%.

Line 5 - Calculate the Tax

Calculate the tax on the amount in each column using the

nd

NOTE: Laws 2011, 2

Special Session, Chapter 1, Section 105,

instructions for 2014 Form 99T, line 6; or 2014 Form 120,

lowers the corporate tax rate for tax year 2015 to 6.0%.

line 16; or 2014 Form 120A, line 8; or 2014 Form 120S,

Calculate the tax on the amount in each column using the

line 12.

instructions for 2014 Form 99T, line 6; or 2014 Form 120, line 16;

Line 33 - Tax From Recapture of Tax Credits

or 2014 Form 120A, line 8; or 2014 Form 120S, line 12.

Calculate the tax from the recapture of the environmental

Line 6 - Tax From Recapture of Tax Credits

technology facility credit, the credits for healthy forest

enterprises, the credit for renewable energy industry, and the

Enter the amount of tax due from recapture of the

credit for qualified facilities.

environmental technology facility, healthy forest enterprises,

renewable energy industry, and qualified facilities tax credits.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4