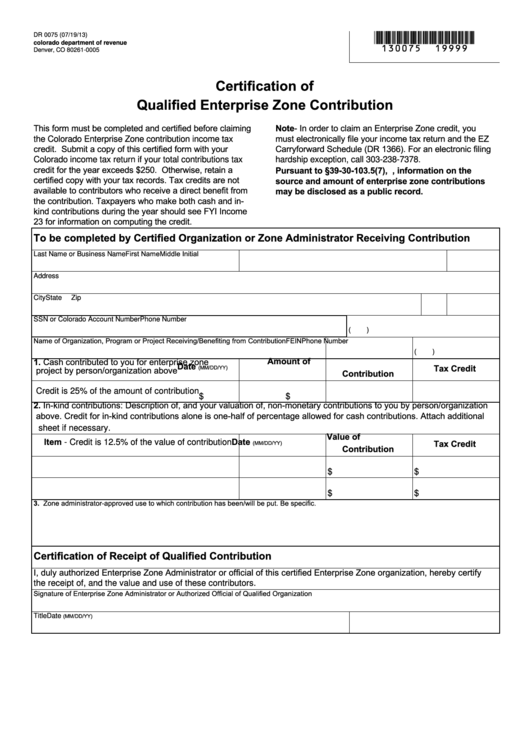

*130075==19999*

DR 0075 (07/19/13)

colorado department of revenue

Denver, CO 80261-0005

Certification of

Qualified Enterprise Zone Contribution

This form must be completed and certified before claiming

Note- In order to claim an Enterprise Zone credit, you

must electronically file your income tax return and the EZ

the Colorado Enterprise Zone contribution income tax

credit. Submit a copy of this certified form with your

Carryforward Schedule (DR 1366). For an electronic filing

Colorado income tax return if your total contributions tax

hardship exception, call 303-238-7378.

credit for the year exceeds $250. Otherwise, retain a

Pursuant to §39-30-103.5(7), C.R.S., information on the

certified copy with your tax records. Tax credits are not

source and amount of enterprise zone contributions

available to contributors who receive a direct benefit from

may be disclosed as a public record.

the contribution. Taxpayers who make both cash and in-

kind contributions during the year should see FYI Income

23 for information on computing the credit.

To be completed by Certified Organization or Zone Administrator Receiving Contribution

First Name

Middle Initial

Last Name or Business Name

Address

City

State

Zip

SSN or Colorado Account Number

Phone Number

(

)

Name of Organization, Program or Project Receiving/Benefiting from Contribution

FEIN

Phone Number

(

)

1. Cash contributed to you for enterprise zone

Amount of

Date

Tax Credit

(MM/DD/YY)

project by person/organization above

Contribution

Credit is 25% of the amount of contribution

$

$

2. In-kind contributions: Description of, and your valuation of, non-monetary contributions to you by person/organization

above. Credit for in-kind contributions alone is one-half of percentage allowed for cash contributions. Attach additional

sheet if necessary.

Value of

Item - Credit is 12.5% of the value of contribution

Date

Tax Credit

(MM/DD/YY)

Contribution

$

$

$

$

3. Zone administrator-approved use to which contribution has been/will be put. Be specific.

Certification of Receipt of Qualified Contribution

I, duly authorized Enterprise Zone Administrator or official of this certified Enterprise Zone organization, hereby certify

the receipt of, and the value and use of these contributors.

Signature of Enterprise Zone Administrator or Authorized Official of Qualified Organization

Title

Date

(MM/DD/YY)

1

1 2

2