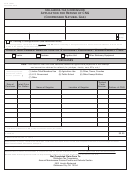

Application for Refund of CNG

(Compressed Natural Gas)

Instructions

The following may apply for a refund of the motor fuel excise tax on CNG (Compressed Natural Gas) where the tax was

previously paid:

Members of Indian tribes that contracted with

1. Tribal members who purchased CNG on Indian country from their tribe.

the State pursuant to Section 500.63 of Title 68 are not eligible for this refund

.

2. Persons who purchased CNG for farm tractors or stationary engines used exclusively for agricultural purposes

upon which the tax was previously paid. Vehicles required to be licensed by the State of Oklahoma are not exempt

regardless of use.

3. CNG purchased to propel vehicles on the public roads and highways of this state, when leased or owned and being

operated for the sole benefit of a county, city or town.

4. CNG purchased by the United States Government or any agency or instrumentality thereof.

5. CNG purchased solely and exclusively in district owned public school vehicles or FFA and 4-H Club trucks for the

purpose of legally transporting public school children, and CNG purchased by any school district for use exclusively

in school buses leased or hired for the purpose of legally transporting public school children, or in the operation of

vehicles used in driver training.

6. CNG purchased by a volunteer fire department with a state certification and rating, rural electric cooperatives, rural

water and sewer districts, rural ambulance service districts.

7. Persons who erroneously paid the CNG tax. Documentation of exempt status must accompany application.

Please Note:

In an effort to minimize administrative costs and expedite processing, the Tax Commission requests that applicants not submit

a refund application until their claim exceeds $25.00.

MAIL COMPLETED CLAIM FORM TO:

Oklahoma Tax Commission

Account Maintenance Division/Credits and Refunds Section

2501 Lincoln Boulevard.

Oklahoma City, OK 73194

1

1 2

2