2015

FORM 1040ME, Page 3

99

*1502111*

Name(s) as shown on Form 1040ME

Your Social Security Number

34a TAX DUE. (Add lines 29, 30, 30a and 31) - NOTE: If total of lines 30, 30a and

.00

31 is greater than line 28, enter the difference as an amount due on this line ........

34a

b Underpayment Penalty. (Attach Form 2210ME.)

.00

Check here if you checked the box on Form 2210, line 17

..........

34b

.00

c TOTAL AMOUNT DUE. (Add lines 34a and 34b.) (Pay in full with return.) ..........

34c

EZ PAY at or ENCLOSE CHECK payable to: Treasurer, State of Maine. DO NOT SEND CASH

If taxpayer is deceased,

If spouse is deceased,

IMPORTANT NOTE

enter date of death.

enter date of death.

(Month)

(Day)

(Year)

(Month)

(Day)

(Year)

Third Party

Do you want to allow another person to discuss this return with Maine Revenue Services?

Yes (complete the following).

No.

Designee

(See page 3)

Designee’s name

Phone no.

Personal identifi cation #:

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

SIGN

HERE

Keep a

Your signature

Date signed

Your occupation

copy of

this return

for your

records

Spouse’s signature (If joint return, both must sign)

Date signed

Spouse’s occupation

Preparer’s signature

Date

Preparer’s phone number

Paid

Preparer’s

Use

Only

Print preparer’s name and name of business

Preparer’s SSN or PTIN

Avoid errors that delay processing of returns:

• • Use black or blue ink. Do not use red ink.

• • Be sure to enter amounts on correct lines.

• • Line A. Check the Property Tax Fairness Credit box, if it applies.

• • Lines 12 and 17. If you are over 65 and/or blind, see the instructions on page 2 and claim the additional amount as allowed.

• • Line 20. Use the correct column from the tax table for your fi ling status.

• • Refund. If you overpaid your tax, enter the amount you want to be refunded on line 33b.

• • Double check social security numbers, fi ling status, and number of exemptions.

• • Double check mathematical calculations.

• • Be sure to sign your return.

• • Enclose W-2 forms with the return.

If requesting a REFUND, mail to: Maine Revenue Services, P.O. Box 1066, Augusta, ME 04332-1066

If NOT requesting a refund, mail to: Maine Revenue Services, P.O. Box 1067, Augusta, ME 04332-1067

Injured

Payment

Spouse

Plan

DO NOT SEND PHOTOCOPIES OF RETURNS

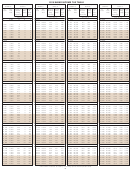

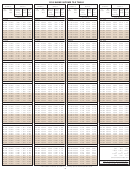

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24