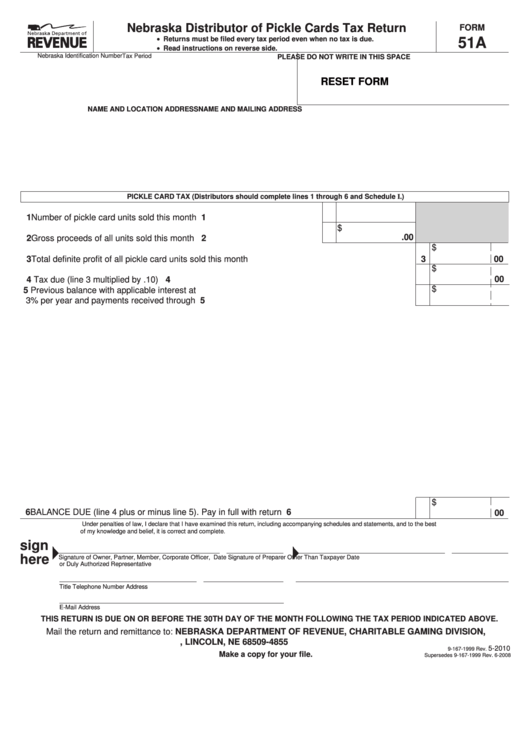

Nebraska Distributor of Pickle Cards Tax Return

FORM

• Returns must be filed every tax period even when no tax is due.

51A

• Read instructions on reverse side.

Nebraska Identification Number

Tax Period

PLEASE DO NOT WRITE IN THIS SPACE

RESET FORM

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

PICKLE CARD TAX (Distributors should complete lines 1 through 6 and Schedule I.)

1 Number of pickle card units sold this month ................................................

1

$

.00

2 Gross proceeds of all units sold this month .................................................

2

$

3 Total definite profit of all pickle card units sold this month ..................................................................

3

00

$

00

4 Tax due (line 3 multiplied by .10) .........................................................................................................

4

$

5 Previous balance with applicable interest at

3% per year and payments received through

5

$

6 BALANCE DUE (line 4 plus or minus line 5). Pay in full with return ....................................................

6

00

Under penalties of law, I declare that I have examined this return, including accompanying schedules and statements, and to the best

of my knowledge and belief, it is correct and complete.

sign

here

Signature of Owner, Partner, Member, Corporate Officer,

Date

Signature of Preparer Other Than Taxpayer

Date

or Duly Authorized Representative

Title

Telephone Number

Address

E-Mail Address

THIS RETURN IS DUE ON OR BEFORE THE 30TH DAY OF THE MONTH FOLLOWING THE TAX PERIOD INDICATED ABOVE.

Mail the return and remittance to: NEBRASKA DEPARTMENT OF REVENUE, CHARITABLE GAMING DIVISION,

P.O. BOX 94855, LINCOLN, NE 68509-4855

5-2010

9-167-1999 Rev.

Make a copy for your file.

Supersedes 9-167-1999 Rev. 6-2008

1

1 2

2