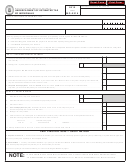

REV-1630 (12-12) (FI)

UNDERPAYMENT OF

2012

ESTIMATED TAX

BY INDIVIDUALS

BUREAU OF INDIVIDUAL TAXES

START

Name as shown on PA-40

Social Security Number

Street Address

City or Post Office

State

ZIP Code

PART I

CALCULATING YOUR UNDERPAYMENT

1a. 2012 Tax Liability from Line 12 of Form PA-40. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1a.

1b. Multiply the amount on Line 1a by 0.90. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1b.

2. Add the amounts reported on Lines 13, 17, 21, 22 and 23 of Form PA-40. . . . . . . . . . . . . . . .

2.

3. Subtract Line 2 from Line 1a. If result is less than $246, stop here. . . . . . . . . . . . . . . . . . . . .

3.

4. Subtract Line 2 from Line 1b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

ESTIMATED PAYMENT DUE DATES - Fiscal filers see instructions.

a

b

c

d

5. Divide Line 4 by the number of payments required for the

April 16, 2012

June 15, 2012

Sept. 17, 2012

Jan. 15, 2013

year (usually four). Enter the result in the appropriate

columns. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Estimated tax paid including carryover credit from previous

tax year. See instructions. . . . . . . . . . . . . . . . . . . . . . . .

6.

7. Overpayment (from Line 10) from a previous period. See

instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Add Lines 6 and 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Underpayment. Subtract Line 8 from Line 5. If Columns a

through d are all zero, stop here. No penalty is due.. . . .

9.

10. Overpayment. Subtract Line 5 from Line 8. If Columns a

through d all show an overpayment, stop here. No penalty

is due. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

PART II

EXCEPTIONS TO INTEREST

You will not have to pay interest on the underpayment if the tax payments you made as shown in Part II, Line 11 were paid on time and

the amount shown on Part II, Line 11 is equal to or more than the amount in Part II, Line 12 or Line 13, for the same payment period. This

exception does not apply if you did not file a return for the prior year or if the prior year’s return was filed as a part-year resident.

a

b

c

d

EXCEPTION 1 WORKSHEET – Part II, Line 11 Calculation

April 16, 2012

June 15, 2012

Sept. 17, 2012

Jan. 15, 2013

A. Divide the amount reported in Part I, Line 2 by 4. Enter the

amount in each of the four columns. . . . . . . . . . . . . . . . . . .

B. Enter the estimated payments reported in Part I, Line 6. Enter

the payments under the installment period in which they were

paid. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

C. Add Lines A and B under each column. . . . . . . . . . . . . . . . .

11. Enter the amounts listed on Exception 1 Worksheet, Line C.

For Column a this is the amount from Line C above. For

Column b add the amounts of Columns a and b from Line C;

for Column c add the amounts from Columns a, b and c;

and for Column d add the amounts from Columns a, b, c

and d. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

12. Exception 1 – Tax on 2011 income using 2012 tax rate.

See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

If the amount on Line 11 is equal to or greater than Line 12, you do not owe penalty for that quarter and you should place an X in the applicable box on Line

14a or 14b for that quarter.

EXCEPTION 2 WORKSHEET – Use this worksheet if your income was earned unevenly throughout 2012 and your 2012 estimated tax payments, tax

withholdings and credits equal at least 90 percent of the tax on your taxable income for the periods.

EXCEPTION 2 WORKSHEET – Part II, Line 13 Calculation

01/01/12 - 03/31/12 01/01/12 - 05/31/12 01/01/12 - 08/31/12 01/01/12 - 12/31/12

A. Enter your actual taxable income for the period.. . . . . . . . . . .

B. Multiply Line A by 3.07 percent (0.0307). This is the tax due. .

13. Exception 2 - Tax on 2012 income over three, five, eight .

Enter 90%

Enter 90%

Enter 90%

Enter 90%

and 12 month periods. Enter 90 percent of Exception 2

Line B. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13.

If the amount on Line 11 is equal to or greater than Line 13, you do not owe penalty for that payment period and you should place an X in the applicable

box on Line 14a or 14b for that quarter.

PRINT FORM

Reset Entire Form

NEXT PAGE

2

1

1 2

2 3

3 4

4