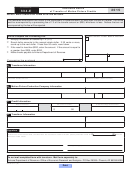

Name (as shown on page 1)

TIN

Part 4

Partner’s Share of Credit

Complete lines 10 through 12 separately for each partner. Furnish each partner with a copy of pages 1 and 2 of Form 334. Provide each

partner with a copy of the post-approval document from Commerce.

10 Name of partner:

11 Partner’s TIN:

12 Partner’s share of the available credit for motion picture production costs for the allocation year

Y Y Y Y

00

from Part 2, line 4 .......................................................................................................... 12

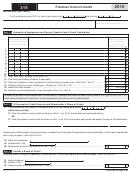

Part 5

Available Credit Carryover

Include Form(s) 334-1 to detail lines 15 and/or 18.

2010

13 Allocation year: See instructions ......................................................................................................

13

00

14 Original credit amount .......................................................................................................................

14

00

15 Credit transfers received: Include schedule .....................................................................................

15

00

16 Available credit: Add lines 14 and 15 ................................................................................................

16

00

17 Amount previously used ....................................................................................................................

17

00

18 Credit transferred to other taxpayer(s): Include schedule ................................................................

18

00

19 Amount unallowable: See instructions..............................................................................................

19

20 Available carryover: Subtract the sum of lines 17 through 19 from line 16 ......................................

00

20

21 TOTAL AVAILABLE CARRYOVER: Enter the amount from line 20.

• Corporations, exempt organizations with UBTI, and S corporation: Also enter this amount on

Form 300, Part 1, line 13, column (b).

00

• Individuals: Also enter this amount on Form 301, Part 1, line 19, column (b) ...............................

21

ADOR 10709 (15)

AZ Form 334 (2015)

Page 2 of 2

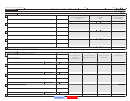

Print 334

1

1 2

2 3

3