Print Form

Arizona Form

2015

Recycling Equipment Credit

307

Include with your return.

For the calendar year 2015 or fiscal year beginning

M M D D

2 0 1 5 and ending

M M D D Y Y Y Y

.

Your Name as shown on Form 140, 140PY, 140NR, 140X

Your Social Security Number

Spouse’s Name as shown on Form 140, 140PY, 140NR, 140X (if a joint return)

Spouse’s Social Security Number

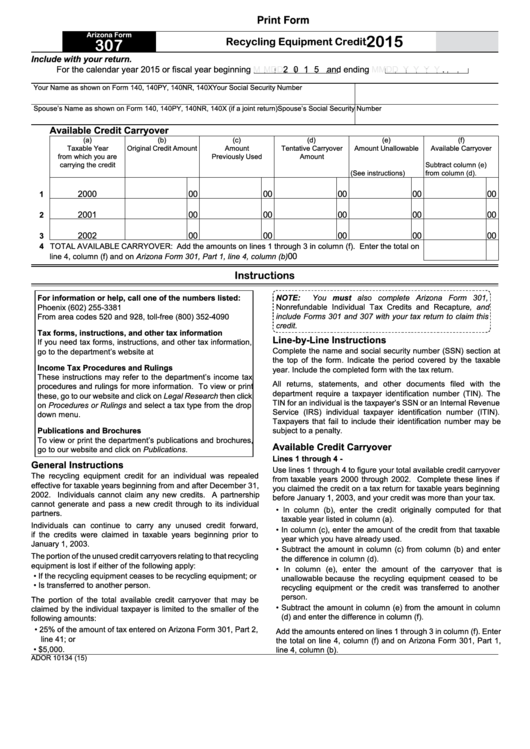

Available Credit Carryover

(a)

(b)

(c)

(d)

(e)

(f)

Taxable Year

Original Credit Amount

Amount

Tentative Carryover

Amount Unallowable

Available Carryover

from which you are

Previously Used

Amount

carrying the credit

Subtract column (e)

(See instructions)

from column (d).

2000

00

00

00

00

00

1

2001

00

00

00

00

00

2

2002

00

00

00

00

00

3

4 TOTAL AVAILABLE CARRYOVER: Add the amounts on lines 1 through 3 in column (f). Enter the total on

00

line 4, column (f) and on Arizona Form 301, Part 1, line 4, column (b) ............................................................

Instructions

For information or help, call one of the numbers listed:

NOTE:

You must also complete Arizona Form 301,

Nonrefundable Individual Tax Credits and Recapture, and

Phoenix

(602) 255-3381

From area codes 520 and 928, toll-free

(800) 352-4090

include Forms 301 and 307 with your tax return to claim this

credit.

Tax forms, instructions, and other tax information

Line-by-Line Instructions

If you need tax forms, instructions, and other tax information,

Complete the name and social security number (SSN) section at

go to the department’s website at

the top of the form. Indicate the period covered by the taxable

Income Tax Procedures and Rulings

year. Include the completed form with the tax return.

These instructions may refer to the department’s income tax

All returns, statements, and other documents filed with the

procedures and rulings for more information. To view or print

department require a taxpayer identification number (TIN). The

these, go to our website and click on Legal Research then click

TIN for an individual is the taxpayer’s SSN or an Internal Revenue

on Procedures or Rulings and select a tax type from the drop

Service (IRS) individual taxpayer identification number (ITIN).

down menu.

Taxpayers that fail to include their identification number may be

Publications and Brochures

subject to a penalty.

To view or print the department’s publications and brochures,

Available Credit Carryover

go to our website and click on Publications.

Lines 1 through 4 -

General Instructions

Use lines 1 through 4 to figure your total available credit carryover

The recycling equipment credit for an individual was repealed

from taxable years 2000 through 2002. Complete these lines if

effective for taxable years beginning from and after December 31,

you claimed the credit on a tax return for taxable years beginning

2002. Individuals cannot claim any new credits. A partnership

before January 1, 2003, and your credit was more than your tax.

cannot generate and pass a new credit through to its individual

• In column (b), enter the credit originally computed for that

partners.

taxable year listed in column (a).

Individuals can continue to carry any unused credit forward,

• In column (c), enter the amount of the credit from that taxable

if the credits were claimed in taxable years beginning prior to

year which you have already used.

January 1, 2003.

• Subtract the amount in column (c) from column (b) and enter

The portion of the unused credit carryovers relating to that recycling

the difference in column (d).

equipment is lost if either of the following apply:

• In column (e), enter the amount of the carryover that is

• If the recycling equipment ceases to be recycling equipment; or

unallowable because the recycling equipment ceased to be

• Is transferred to another person.

recycling equipment or the credit was transferred to another

person.

The portion of the total available credit carryover that may be

• Subtract the amount in column (e) from the amount in column

claimed by the individual taxpayer is limited to the smaller of the

(d) and enter the difference in column (f).

following amounts:

• 25% of the amount of tax entered on Arizona Form 301, Part 2,

Add the amounts entered on lines 1 through 3 in column (f). Enter

line 41; or

the total on line 4, column (f) and on Arizona Form 301, Part 1,

• $5,000.

line 4, column (b).

ADOR 10134 (15)

1

1