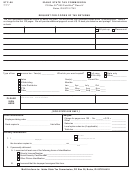

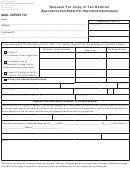

Request For Copy

Instructions

1. This form must be filled out accurately and completely.

3.

Be specific when entering the tax period of the

It must also be notarized. For security purposes, the

return(s). For example, if you want copies of your

Colorado Department of Revenue does everything it

returns for the tax years 2005 through 2010, enter

can to keep taxpayer information confidential. These

January 2005 in the Beginning column and December

precautions are necessary to ensure against potential

2010 in the Ending column. Do not complete a

identity theft. The Tax Files Office cannot accept

separate form for each year you are requesting.

requests for copies by fax because original signatures

of both the requester and the notary are required for

4. To request a copy of a return(s) for another taxpayer,

security purposes.

a written authorization (a Power of Attorney or, if

Mail the completed form to:

applicable, a copy of a death certificate) will be required

before we can release the information. The individual’s

Colorado Department of Revenue

signature on the front of this form is also acceptable.

Tax Files - Room 338

P.O. Box 17087

5.

It will take from seven to ten days to receive your

Denver, CO 80217-0087

copies. If your request results in more than 10 pages,

you will be notified of the total cost. Copies will not be

2.

The Colorado Department of Revenue retains copies

released until we receive payment.

of tax returns for nine years plus the first six months

of the calendar year. For example, a 2012 document

6. Please call us at 303-866-5407 if you have any

is available until June 30, 2022. This copy retention

questions. We do not maintain federal records. To

schedule is established by the Colorado Attorney

obtain federal returns or information, contact the

General, the State Archivist and the State Auditor.

Internal Revenue Service.

Common Requests:

Form Title

Form Number

Individual Income Tax Return

DR 0104

Retail Sales Tax Return

DR 0100

If there is a cost for copies you will be notified before

your request will be processed.

1

1 2

2