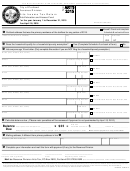

Form Sc1040 - Individual Income Tax Return - 2015 Page 3

ADVERTISEMENT

Page 3 of 3

2015

PAYMENTS AND REFUNDABLE CREDITS

20 Other SC withholding

16 SC INCOME TAX WITHHELD

00

(Attach Form 1099) . . . . . . .

(Attach W-2 or SC41) . . . . . . . . . . .

00

00

17 2015 estimated tax payments

21 Tuition tax credit

(Attach I-319) . . . . . . . . . . . .

00

00

18 Amount paid with extension . .

00

19 NR sale of real estate . . . . . .

00

22 Other refundable credit(s)

Anhydrous Ammonia (Attach I-333)

Check

Milk Credit (Attach I-334)

Type:

Classroom Teacher Expenses (Attach I-360)

Exceptional Needs Children Education (Attach I-361)

00

23 Add lines 16 through 22 and enter the total here.. . . . . . . . . . . . . . . . . . . . . . . These are your TOTAL PAYMENTS

23

00

24 If line 23 is LARGER than line 15, subtract line 15 from line 23 and enter the OVERPAYMENT . . . . . . . . . . . . . . . .

24

00

25 If line 15 is LARGER than line 23, subtract line 23 from line 15 and enter the AMOUNT DUE . . . . . . . . . . . . . . . . . .

25

00

26

USE TAX due on internet, mail-order or out-of-state purchases. . . . . . . . . . . . . . .

26

Use tax is based on your county’s sales tax rate. See instructions for more information.

If you certify that no use tax is due, check here . . .

00

27

Amount of line 24 to be credited to your 2016 Estimated Tax . . . . . . . . . . . . . . .

27

00

28 Total Contributions for Check-offs

. . . . . . . . . . . . . . . . . . . . . . . . . . .

(Attach I-330)

28

00

29

Add lines 26 through 28 and enter the total here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

30 If line 29 is larger than line 24, go to line 31. Otherwise, subtract line 29 from line 24 and enter the

REFUND

AMOUNT TO BE REFUNDED TO YOU (line 30a check box entry is required). . . . . . . . . . . . . . . .

00

30

REFUND OPTIONS (subject to program limitations)

Direct Deposit

30a Mark one refund choice:

Debit Card*

Paper Check

(30b required)

*SCDOR Income Tax Refund Prepaid Debit Card issued by Bank Of America

30b Direct Deposit (for US Accounts Only) Type:

Checking

Savings

Must be 9 digits. The first two numbers of the

Routing Number (RTN)

RTN must be 01 through 12 or 21 through 32

1-17 digits

Bank Account Number (BAN)

00

31

Tax Due: Add lines 25 and 29. If line 29 is larger than line 24, subtract line 24 from line 29 and enter the amount . .

31

00

32

Late filing and/or late payment: Penalties _________ Interest ________

Enter total here . . . . .

32

(See instructions)

33

Penalty for Underpayment of Estimated Tax (Attach SC2210) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Exception to Underpayment of Estimated Tax

00

(See instructions and enter letter in box if applicable)

33

BALANCE DUE

00

34

34

Add lines 31 through 33 and enter the AMOUNT YOU OWE here. Attach Form SC1040-V with payment.

Pay electronically free of charge at Click on DORePay and pay with Visa, MasterCard or by Electronic Funds Withdrawal

(EFW) or include SC1040-V with your check or money order for the full amount payable to “SC Department of Revenue.” Write your social

security number and “2015 SC1040” on the payment.

I declare that this return and all attachments are true, correct and complete to the best of my knowledge and belief.

Your signature

Date

Spouse's signature (if married filing jointly, BOTH must sign)

Taxpayer's Email

Preparer's printed name

I authorize the Director of the SC Department of Revenue or delegate to

Yes

No

discuss this return, attachments and related tax matters with the preparer.

If prepared by a person other than the taxpayer, his declaration is based on all information of which he has any knowledge.

Date

Check

PTIN

Preparer

Paid

if self-

signature

employed

Preparer's

Firm name (or yours

FEIN

Use Only

if self-employed) and

Phone No.

address and Zip Code

MAIL TO:

SC1040 Processing Center, PO Box 101100, Columbia, SC 29211-0100

REFUNDS OR ZERO TAX

Taxable Processing Center, PO Box 101105, Columbia, SC 29211-0105

BALANCE DUE

30753024

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4