Save

Print

Clear

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

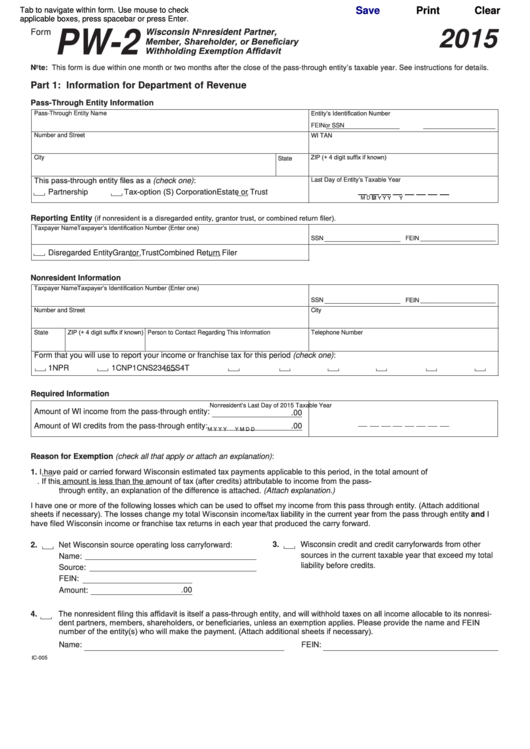

Form

Wisconsin Nonresident Partner,

PW-2

2015

Member, Shareholder, or Beneficiary

Withholding Exemption Affidavit

Note: This form is due within one month or two months after the close of the pass-through entity’s taxable year. See instructions for details.

Part 1: Information for Department of Revenue

Pass-Through Entity Information

Entity’s Identification Number

Pass-Through Entity Name

FEIN

or SSN

Number and Street

WI TAN

ZIP (+ 4 digit suffix if known)

City

State

This pass-through entity files as a (check one):

Last Day of Entity’s Taxable Year

Tax-option (S) Corporation

Partnership

Estate or Trust

M

M

D

D

Y

Y

Y

Y

(if nonresident is a disregarded entity, grantor trust, or combined return filer).

Reporting Entity

Taxpayer’s Identification Number (Enter one)

Taxpayer Name

SSN

FEIN

Disregarded Entity

Grantor Trust

Combined Return Filer

Nonresident Information

Taxpayer’s Identification Number (Enter one)

Taxpayer Name

SSN

FEIN

Number and Street

City

ZIP (+ 4 digit suffix if known)

State

Person to Contact Regarding This Information

Telephone Number

Form that you will use to report your income or franchise tax for this period (check one):

1NPR

1CNP

1CNS

2

3

4

4T

5S

6

Required Information

Nonresident’s Last Day of 2015 Taxable Year

Amount of WI income from the pass-through entity:

.00

Amount of WI credits from the pass-through entity:

.00

M

M

D

D

Y

Y

Y

Y

Reason for Exemption (check all that apply or attach an explanation):

I have paid or carried forward Wisconsin estimated tax payments applicable to this period, in the total amount of

1.

. If this amount is less than the amount of tax (after credits) attributable to income from the pass-

through entity, an explanation of the difference is attached. (Attach explanation.)

I have one or more of the following losses which can be used to offset my income from this pass through entity. (Attach additional

sheets if necessary). The losses change my total Wisconsin income/tax liability in the current year from the pass through entity and I

have filed Wisconsin income or franchise tax returns in each year that produced the carry forward.

3.

Wisconsin credit and credit carryforwards from other

2.

Net Wisconsin source operating loss carryforward:

sources in the current taxable year that exceed my total

Name:

liability before credits.

Source:

FEIN:

Amount:

.00

The nonresident filing this affidavit is itself a pass-through entity, and will withhold taxes on all income allocable to its nonresi-

4.

dent partners, members, shareholders, or beneficiaries, unless an exemption applies. Please provide the name and FEIN

number of the entity(s) who will make the payment. (Attach additional sheets if necessary).

Name:

FEIN:

IC-005

1

1 2

2