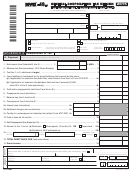

41A750 (9-15)

Page 3

*1500030304*

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Schedule K. BALANCE SHEETS

Beginning of Taxable Year

End of Taxable Year

ASSETS

Amount

Total

Amount

Total

1. Cash ................................................................

2. Notes and accounts receivable ....................

(a) Less: Reserve for bad debts ...................

3. Inventories:

(a) Other than last-in, first-out .....................

(b) Last-in, first-out .......................................

4. Prepaid expenses and supplies ....................

5. Investments (income from which is

nontaxable) ....................................................

6. Other investments (attach schedule) ...........

7. Buildings and other fixed depreciable assets ..

(a) Less: Accumulated depreciation ............

8. Depletable assets...........................................

(a) Less: Accumulated depletion .................

9. Land ................................................................

10. Intangible assets (amortizable only) ............

(a) Less: Accumulated amortization ............

11. Other assets (attach schedule) ......................

12. TOTAL ASSETS ..............................................

LIABILITIES AND CAPITAL

13. Accounts payable ..........................................

14. Bonds, notes and mortgages payable:

(a) With original maturity of less than 1 year ..

(b) With original maturity of 1 year or more..

15. Accrued expenses (attach schedule) ............

16. Other liabilities (attach schedule) .................

17. Capital Stock:

Enter number as at end of year—

(Shares) (Shareholders)

(a) Preferred stock (__________)(__________)

(b) Common stock (__________)(__________)

18. Paid-in or capital surplus ..............................

19. Surplus reserves (attach schedule) ..............

20. Earned surplus and undivided profits .........

21. TOTAL LIABILITIES AND CAPITAL ................

Schedule L. RECONCILIATION OF NET INCOME AND ANALYSIS OR EARNED SURPLUS AND UNDIVIDED PROFITS

1. Earned surplus and undivided profits at

6. Total distributions to stockholders charged

close of preceding taxable year ..........................

to earned surplus during taxable year:

2. Taxable net income (page 1, line 30) ..................

(a) Cash ...............................................................

3. (a) Obligations of Kentucky, its political

(b) Stock of the corporation ...............................

subdivisions, municipalities and

(c) Other property...............................................

instrumentation ..............................................

7. Sundry debits to earned surplus (attach schedule)

(b) Obligations of the United States ...................

8. Other unallowable deductions (attach schedule)

4. Sundry credits to earned surplus (attach

9. Total of lines 6 through 8 .....................................

schedule) ...............................................................

10. Earned surplus and undivided profits at close

5. Total of lines 1 through 4 .....................................

of the taxable year (line 5 less line 9) .................

1

1 2

2 3

3 4

4