*141083==29999*

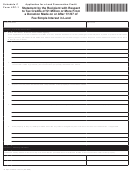

Affirmation of Colorado Residency

I (we) hereby affirm that I am (we are) the transferor(s) or the fiduciary of the transferor of the property described on this

DR 1083 and that as of the date of closing I am (we are) or the estate or the trust is a resident of the State of Colorado.

Signed under the penalty of perjury

Signature of transferor or fiduciary

Date

(MM/DD/YY)

Spouse's signature (if applicable)

Date

(MM/DD/YY)

Affirmation of Permanent Place of Business

I hereby affirm that the transferor of the property described on this DR 1083 is a corporation which maintains a

permanent place of business in Colorado.

Signed under the penalty of perjury.

Signature of corporate officer

Date

(MM/DD/YY)

Affirmation of Sale by Partnership

I hereby affirm that the transfer of property described on this DR 1083 was sold by an organization defined as a

partnership under section 761(a) of the Internal Revenue Code and required to file an annual federal partnership return

of income under section 6031(a) of the Internal Revenue Code.

Signed under the penalty of perjury.

Signature of general partner

Date

(MM/DD/YY)

Affirmation of Principal Residence

I hereby affirm that I am (we are) the transferor(s) of the property described on this DR 1083 and immediately prior to the

transfer it was my (our) principal residence which could qualify for the exclusion of gain provision of section 121 of the

Internal Revenue Code.

Signed under the penalty of perjury.

Signature of transferor

Date

(MM/DD/YY)

Spouse's signature if applicable

Date

(MM/DD/YY)

Affirmation of No Reasonably Estimated Tax to be Due

I hereby affirm that I am (we are) the transferor(s) or an officer of the corporate-transferor or a fiduciary of the estate

or trust-transferor of the property described on the front side of this form, and I (we) further affirm that there will be no

Colorado income tax reasonably estimated to be due on the part of the transferor(s) as a result of any gain realized on

the transfer.

Please understand before you sign this affirmation that nonresidents of Colorado are subject to Colorado tax

on gains from the sale of Colorado real estate to the extent such gains are included in federal taxable income.

Signed under the penalty of perjury.

Signature of transferor, officer or fiduciary

Date

(MM/DD/YY)

Spouse's signature if applicable

Date

(MM/DD/YY)

1

1 2

2 3

3 4

4