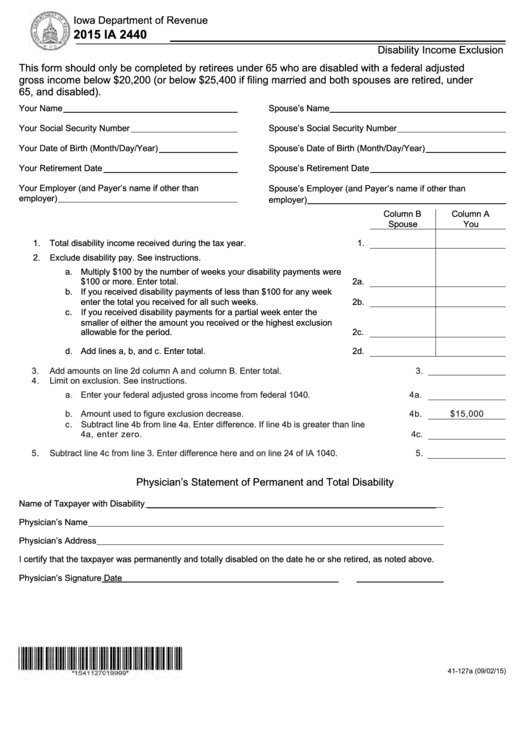

Iowa Department of Revenue

2015 IA 2440

https://tax.iowa.gov

Disability Income Exclusion

This form should only be completed by retirees under 65 who are disabled with a federal adjusted

gross income below $20,200 (or below $25,400 if filing married and both spouses are retired, under

65, and disabled).

Your Name

Spouse’s Name

Your Social Security Number

Spouse’s Social Security Number

Your Date of Birth (Month/Day/Year)

Spouse’s Date of Birth (Month/Day/Year)

Your Retirement Date

Spouse’s Retirement Date

Your Employer (and Payer’s name if other than

Spouse’s Employer (and Payer’s name if other than

employer)

employer)

Column B

Column A

Spouse

You

1.

Total disability income received during the tax year. ......................................... 1.

2.

Exclude disability pay. See instructions.

a. Multiply $100 by the number of weeks your disability payments were

$100 or more. Enter total. ...................................................................... 2a.

b. If you received disability payments of less than $100 for any week

enter the total you received for all such weeks. .................................... 2b.

c. If you received disability payments for a partial week enter the

smaller of either the amount you received or the highest exclusion

allowable for the period. ......................................................................... 2c.

d. Add lines a, b, and c. Enter total. .......................................................... 2d.

3.

Add amounts on line 2d column A and column B. Enter total. ...................................

3.

4.

Limit on exclusion. See instructions.

a. Enter your federal adjusted gross income from federal 1040. .....................

4a.

b. Amount used to figure exclusion decrease. .................................................. 4b.

$15,000

c. Subtract line 4b from line 4a. Enter difference. If line 4b is greater than line

4a, enter zero. ............................................................................................ 4c.

5.

Subtract line 4c from line 3. Enter difference here and on line 24 of IA 1040. ............

5.

Physician’s Statement of Permanent and Total Disability

Name of Taxpayer with Disability _____________________________________________________________

Physician’s Name

Physician’s Address

I certify that the taxpayer was permanently and totally disabled on the date he or she retired, as noted above.

Physician’s Signature

Date

41-127a (09/02/15)

1

1 2

2