Click Here to Clear Form Info

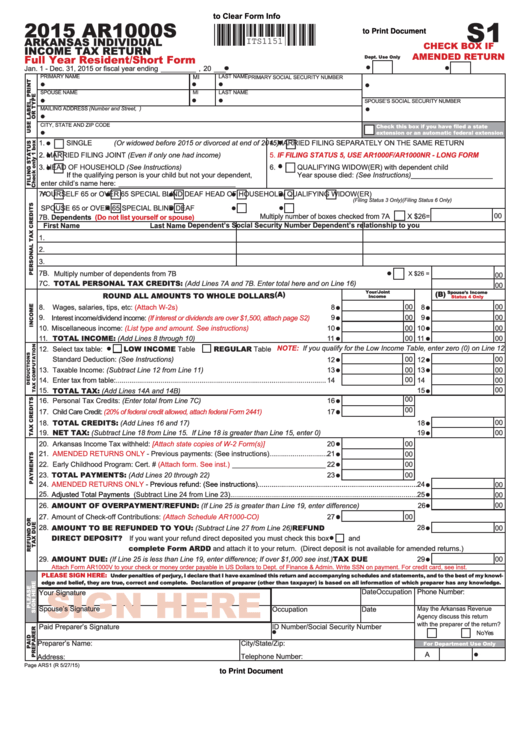

2015 AR1000S

S1

Click Here to Print Document

ITS1151

ARKANSAS INDIVIDUAL

CHECK BOX IF

INCOME TAX RETURN

AMENDED RETURN

Dept. Use Only

Full Year Resident/Short Form

-DQ� � � 'HF� ��� ���� RU ¿VFDO \HDU HQGLQJ _________ , 20 ___

PRIMARY NAME

MI

LAST NAME

PRIMARY SOCIAL SECURITY NUMBER

SPOUSE NAME

MI

LAST NAME

SPOUSE’S SOCIAL SECURITY NUMBER

MAILING ADDRESS (Number and Street, P.O. Box or Rural Route)

(QWHU 661�V� DERYH

CITY, STATE AND ZIP CODE

&KHFN WKLV ER[ LI \RX KDYH ÀOHG D VWDWH

extension or an automatic federal extension

4.

MARRIED FILING SEPARATELY ON THE SAME RETURN

1.

SINGLE (Or widowed before 2015 or divorced at end of 2015)

5.

IF FILING STATUS 5, USE AR1000F/AR1000NR - LONG FORM

2.

MARRIED FILING JOINT (Even if only one had income)

3.

HEAD OF HOUSEHOLD (See Instructions)

��

48$/,)<,1* :,'2:�(5� ZLWK GHSHQGHQW FKLOG

<HDU VSRXVH GLHG� (See Instructions)_____________________

,I WKH TXDOLI\LQJ SHUVRQ LV \RXU FKLOG EXW QRW \RXU GHSHQGHQW�

HQWHU FKLOG¶V QDPH KHUH� ______________________________

7A.

YOURSELF

65 or OVER

65 SPECIAL

BLIND

DEAF

HEAD OF HOUSEHOLD/ QUALIFYING WIDOW(ER)

(Filing Status 3 Only)

(Filing Status 6 Only)

SPOUSE

65 or OVER

65 SPECIAL

BLIND

DEAF

00

0XOWLSO\ QXPEHU RI ER[HV FKHFNHG IURP �$

X $26=

7B. Dependents

(Do not list yourself or spouse)

First Name

Last Name

Dependent’s Social Security Number Dependent’s relationship to you

1.

2.

3.

7B.

0XOWLSO\ QXPEHU RI GHSHQGHQWV IURP �% ...........................................................................................................

X $26 =

00

7C. TOTAL PERSONAL TAX CREDITS: (Add Lines 7A and 7B. Enter total here and on Line 16)..................................7C

00

Your/Joint

Spouse’s Income

(A)

(B)

ROUND ALL AMOUNTS TO WHOLE DOLLARS

Income

Status 4 Only

00

00

8.

:DJHV� VDODULHV� WLSV� HWF�

�$WWDFK :��V�

.............................................................................

8

8

9.

9

00

9

00

,QWHUHVW LQFRPH�GLYLGHQG LQFRPH�

..........

(If interest or dividends are over $1,500, attach page S2)

10.

0LVFHOODQHRXV LQFRPH�

........................................

10

00

10

00

(List type and amount. See instructions)

11.

TOTAL INCOME: (Add Lines 8 through 10) ...................................................................

11

00

11

00

NOTE:

12.

6HOHFW WD[ WDEOH�

LOW INCOME 7DEOH

REGULAR 7DEOH

If you qualify for the Low Income Table, enter zero (0) on Line 12

00

00

6WDQGDUG 'HGXFWLRQ� (See Instructions)..............................................................................

12

12

13.

7D[DEOH ,QFRPH� (Subtract Line 12 from Line 11)...............................................................

13

00

13

00

00

14.

(QWHU WD[ IURP WDEOH�������������������������������������������������������������������������������������������������������������

14

14

00

00

15.

15

TOTAL TAX: (Add Lines 14A and 14B)..........................................................................................................................

00

16.

3HUVRQDO 7D[ &UHGLWV� (Enter total from Line 7C).................................................................

16

00

17.

&KLOG &DUH &UHGLW�

17

(20% of federal credit allowed, attach federal Form

2441).................................

00

18.

18

TOTAL CREDITS: (Add Lines 16 and 17).....................................................................................................................

19.

19

00

NET TAX: (Subtract Line 18 from Line 15. If Line 18 is greater than Line 15, enter 0)..................................................

20.

$UNDQVDV ,QFRPH 7D[ ZLWKKHOG�

20

00

[Attach state copies of W-2

Form(s)]................................

21.

AMENDED RETURNS ONLY

� 3UHYLRXV SD\PHQWV� �6HH LQVWUXFWLRQV�������������������������������

21

00

22.

(DUO\ &KLOGKRRG 3URJUDP� &HUW�

�$WWDFK IRUP� 6HH LQVW��

________________________

22

00

23.

23

00

TOTAL PAYMENTS: (Add Lines 20 through 22).............................................................

24.

AMENDED RETURNS ONLY

� 3UHYLRXV UHIXQG� �6HH LQVWUXFWLRQV�����������������������������������������������������������������������������������

24

00

25.

$GMXVWHG 7RWDO 3D\PHQWV

�6XEWUDFW /LQH �� IURP /LQH ����������������������������������������������������������������������������������������������������

25

00

00

26.

26

AMOUNT OF OVERPAYMENT/REFUND: (If Line 25 is greater than Line 19, enter difference)..............................

27.

$PRXQW RI &KHFN�RII &RQWULEXWLRQV�

27

00

(Attach Schedule

AR1000-CO)..................................

28

28.

AMOUNT TO BE REFUNDED TO YOU: (Subtract Line 27 from Line 26) ...............................................REFUND

00

DIRECT DEPOSIT? ,I \RX ZDQW \RXU UHIXQG GLUHFW GHSRVLWHG \RX PXVW FKHFN WKLV ER[

DQG

complete Form ARDD DQG DWWDFK LW WR \RXU UHWXUQ� �'LUHFW GHSRVLW LV QRW DYDLODEOH IRU DPHQGHG UHWXUQV��

29.

AMOUNT DUE: (If Line 25 is less than Line 19, enter difference; If over $1,000 see inst.) ........................TAX DUE

29

00

$WWDFK )RUP $5����9 WR \RXU FKHFN RU PRQH\ RUGHU SD\DEOH LQ 86 'ROODUV WR 'HSW� RI )LQDQFH

$GPLQ� :ULWH 661 RQ SD\PHQW� )RU FUHGLW FDUG� VHH LQVW�

PLEASE SIGN HERE:

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowl-

edge and belief, they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

2FFXSDWLRQ

Date

3KRQH 1XPEHU�

<RXU 6LJQDWXUH

SIGN HERE

6SRXVH¶V 6LJQDWXUH

2FFXSDWLRQ

Date

0D\ WKH $UNDQVDV 5HYHQXH

$JHQF\ GLVFXVV WKLV UHWXUQ

ZLWK WKH SUHSDUHU RI WKH UHWXUQ"

,' 1XPEHU�6RFLDO 6HFXULW\ 1XPEHU

3DLG 3UHSDUHU¶V 6LJQDWXUH

<HV

No

3UHSDUHU¶V 1DPH�

&LW\�6WDWH�=LS�

For Department Use Only

A

7HOHSKRQH 1XPEHU�

$GGUHVV�

3DJH $56� �5 ��������

Click Here to Print Document

1

1 2

2