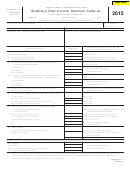

Schedule K-1 (Form N-20) (REV. 2014)

Page 2

(b) Attributable to

(c) Attributable

(d) Form N-11 & N-15 filers

(a) Distributive share items

Hawaii

Everywhere

enter the amount in column (b)

and /or column (c) on:

22 High Technology Business Investment Tax Credit ........................................

Form N-318

23 Credit for School Repair and Maintenance ...................................................

Form N-330

24 Ethanol Facility Tax Credit ............................................................................

Form N-324

See attached Form N-342A

25 Renewable Energy Technologies Income Tax Credit ....................................

Form N-342

26 Important Agricultural Land Qualified Agricultural Cost Tax Credit ...............

Form N-344

27 Tax Credit for Research Activities .................................................................

Form N-346

28 Capital Infrastructure Tax Credit ...................................................................

Form N-348

29 Credit for income tax withheld on Form N-288 (net of refunds) ....................

Sch. CR, line 23a

30 a Interest expense on investment debts .....................................................

Form N-158, line 1

b (1) Investment income included on Schedule K-1, lines 5 through 7......

See Partner’s Instructions for

}

.

(2) Investment expenses included in Schedule K-1, line 14 ...................

Schedule K-1 (Form N-20)

31 Recapture of Hawaii Low-Income Housing Tax Credit

}

Form N-586, Part III

a From IRC section 42(j)(5) partnerships ...................................................

b Other than on line 31a .............................................................................

32 Capital Goods Excise Tax Credit Properties .................................................

See attached Form N-312, Part II

Form N-312, Part II

33 Recapture of High Technology Business Investment Tax Credit ...................

Form N-318, Part III

34 Recapture of Tax Credit for Flood Victims .....................................................

Form N-338

35 Recapture of Important Agricultural Land Qualified Agricultural

Cost Tax Credit .............................................................................................

Form N-344

36 List below other items and amounts not included on lines 1 through 35

See Partner’s Instructions for

that are required to be reported separately to each partner

Schedule K-1 (Form N-20).

Other Information Provided by Partnership:

1

1 2

2