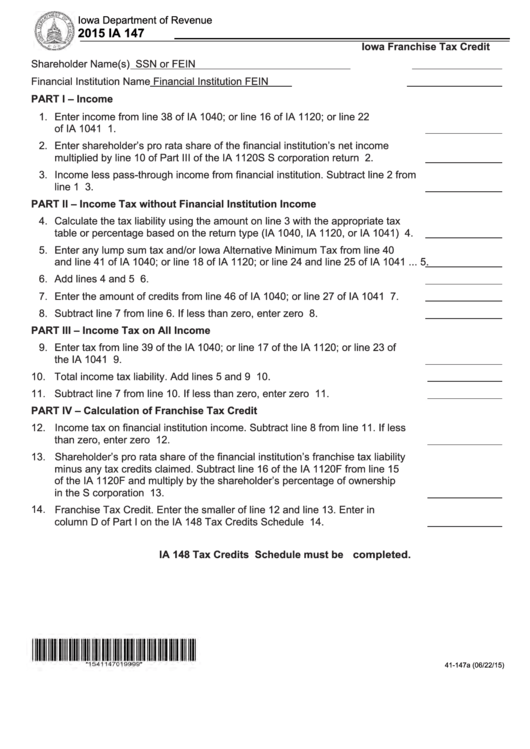

Iowa Department of Revenue

2015 IA 147

https://tax.iowa.gov

Iowa Franchise Tax Credit

Shareholder Name(s)

SSN or FEIN

Financial Institution Name

Financial Institution FEIN

PART I – Income

1. Enter income from line 38 of IA 1040; or line 16 of IA 1120; or line 22

of IA 1041 ................................................................................................................ 1.

2. Enter shareholder’s pro rata share of the financial institution’s net income

multiplied by line 10 of Part III of the IA 1120S S corporation return ...................... 2.

3. Income less pass-through income from financial institution. Subtract line 2 from

line 1 ....................................................................................................................... 3.

PART II – Income Tax without Financial Institution Income

4. Calculate the tax liability using the amount on line 3 with the appropriate tax

table or percentage based on the return type (IA 1040, IA 1120, or IA 1041) ..... 4.

5. Enter any lump sum tax and/or Iowa Alternative Minimum Tax from line 40

and line 41 of IA 1040; or line 18 of IA 1120; or line 24 and line 25 of IA 1041 ... 5.

6. Add lines 4 and 5 ................................................................................................ 6.

7. Enter the amount of credits from line 46 of IA 1040; or line 27 of IA 1041 .......... 7.

8. Subtract line 7 from line 6. If less than zero, enter zero ...................................... 8.

PART III – Income Tax on All Income

9. Enter tax from line 39 of the IA 1040; or line 17 of the IA 1120; or line 23 of

the IA 1041 ......................................................................................................... 9.

10. Total income tax liability. Add lines 5 and 9 ...................................................... 10.

11. Subtract line 7 from line 10. If less than zero, enter zero .................................. 11.

PART IV – Calculation of Franchise Tax Credit

12. Income tax on financial institution income. Subtract line 8 from line 11. If less

than zero, enter zero ......................................................................................... 12.

13. Shareholder’s pro rata share of the financial institution’s franchise tax liability

minus any tax credits claimed. Subtract line 16 of the IA 1120F from line 15

of the IA 1120F and multiply by the shareholder’s percentage of ownership

in the S corporation ........................................................................................... 13.

14. Franchise Tax Credit. Enter the smaller of line 12 and line 13. Enter in

column D of Part I on the IA 148 Tax Credits Schedule .................................... 14.

IA 148 Tax Credits Schedule must be completed.

41-147a (06/22/15)

1

1 2

2