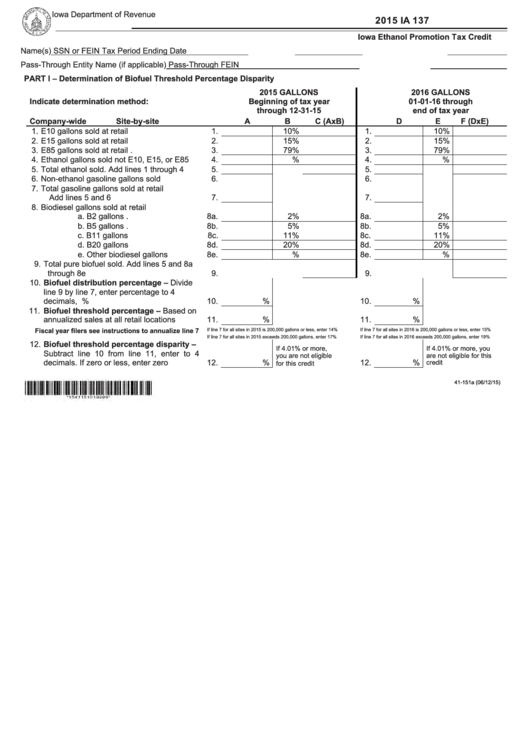

Iowa Department of Revenue

2015 IA 137

https://tax.iowa.gov

Iowa Ethanol Promotion Tax Credit

Name(s)

SSN or FEIN

Tax Period Ending Date

Pass-Through Entity Name (if applicable)

Pass-Through FEIN

PART I – Determination of Biofuel Threshold Percentage Disparity

2015 GALLONS

2016 GALLONS

Indicate determination method:

Beginning of tax year

01-01-16 through

through 12-31-15

end of tax year

Company-wide

Site-by-site

A

B

C (AxB)

D

E

F (DxE)

1. E10 gallons sold at retail ...............................

1.

10%

1.

10%

2. E15 gallons sold at retail ...............................

2.

15%

2.

15%

3. E85 gallons sold at retail ...............................

3.

79%

3.

79%

4. Ethanol gallons sold not E10, E15, or E85 ....

4.

%

4.

%

5. Total ethanol sold. Add lines 1 through 4 ......

5.

5.

6. Non-ethanol gasoline gallons sold .................

6.

6.

7. Total gasoline gallons sold at retail

Add lines 5 and 6 .......................................

7.

7.

8. Biodiesel gallons sold at retail

a. B2 gallons ................................. 8a.

2%

8a.

2%

b. B5 gallons ................................. 8b.

5%

8b.

5%

c. B11 gallons ............................... 8c.

11%

8c.

11%

d. B20 gallons ............................... 8d.

20%

8d.

20%

e. Other biodiesel gallons .............. 8e.

%

8e.

%

9. Total pure biofuel sold. Add lines 5 and 8a

through 8e ..................................................

9.

9.

10. Biofuel distribution percentage – Divide

line 9 by line 7, enter percentage to 4

decimals, i.e. 12.05% ................................... 10.

%

10.

%

11. Biofuel threshold percentage – Based on

annualized sales at all retail locations .......... 11.

%

11.

%

Fiscal year filers see instructions to annualize line 7

If line 7 for all sites in 2015 is 200,000 gallons or less, enter 14%

If line 7 for all sites in 2016 is 200,000 gallons or less, enter 15%

If line 7 for all sites in 2015 exceeds 200,000 gallons, enter 17%

If line 7 for all sites in 2016 exceeds 200,000 gallons, enter 19%

12. Biofuel threshold percentage disparity –

If 4.01% or more,

If 4.01% or more, you

Subtract line 10 from line 11, enter to 4

you are not eligible

are not eligible for this

decimals. If zero or less, enter zero ............. 12.

%

12.

%

for this credit

credit

41-151a (06/12/15)

1

1 2

2 3

3 4

4 5

5