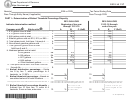

2015 IA 137 Ethanol Promotion Tax Credit Instructions

An Ethanol Promotion Tax Credit is available to retail dealers of

this form must be completed and included with the Iowa tax

ethanol blended gasoline who operate fuel pumps at an Iowa

return. The tax credit must be allocated to the individual members

retail fuel site. Tank wagons are considered retail fuel sites.

in the ratio of each member’s share of the earnings of the entity to

the entity’s total earnings. On Schedule K-1 or on an attachment

The retail dealer can choose to compute the biofuel distribution

to Schedule K-1, report the tax credit for each member and

percentage, biofuel threshold percentage disparity, and tax credit

instruct the members to report the apportioned tax credit on line

on a Company-wide or Site-by-site basis. The Company-wide or

2 of Part III on the IA 137 and include it with their tax returns.

Site-by-site method chosen with the first return that begins on or

after January 1, 2011 is binding on the retail dealer for

The Ethanol Promotion Tax Credit can be claimed even if the

subsequent tax years unless the retail dealer petitions the

taxpayer also claims the E85 Gasoline Promotion Tax Credit

Department for a change in the method.

(Form IA 135) or the E15 Plus Gasoline Promotion Tax Credit

(Form IA 138) for the same ethanol gallons sold.

If the retail dealer chooses the company-wide method, then Part

I and Part II of the form will include sales at all retail locations in

Any tax credit in excess of tax liability can be refunded or

Iowa, and only one Part I and one Part II will be completed. If

credited to tax liability for the following year.

the retail dealer chooses the site-by-site method, then Part I and

Part I - Determination of Biofuel Distribution Percentage

Part II of the form must be completed for each retail fuel site in

Calendar year filers:

Iowa eligible for the tax credit. Only one Part III must be

completed under either method. If the site-by-site method is

If the taxpayer files a tax return on a calendar year basis, then

chosen, the retail sales at all sites in Iowa must be included in

only 2015 gallons need to be reported.

determining the biofuel threshold percentage on line 11 of Part I.

Fiscal year filers:

Example: A retail dealer files on a calendar year basis, and

If a taxpayer files a tax return for a fiscal year that extends into

chooses the site-by-site method to compute the tax credit. The

2016, the calculation must be performed separately for all

retail dealer has two sites in Iowa, and each site sells 125,000

gallons sold during 2015 and for all gallons sold from January

gallons of gasoline during 2015. The retail dealer must enter

1, 2016, through the end of the taxpayer’s fiscal year.

15% as the biofuel threshold percentage on line 11 of each

Line 5: Total ethanol sold - Total ethanol is the total number of

Part I since the total gallons sold during 2015 at all retail sites

pure ethanol gallons sold at retail. This is computed on lines 1-4

in Iowa exceeds 200,000 gallons.

by multiplying the ethanol blended gallons sold (column A/D) by

Provide your name, SSN or FEIN, and tax period ending date. If

the appropriate ethanol content percentage (column B/E). For

the Ethanol Promotion Tax Credit was passed through to you by

example, 10,000 gallons of ethanol blended gasoline formulated

a partnership, LLC, S corporation, estate, or trust, also provide

with 10% by volume of ethanol results in 1,000 gallons of pure

that entity name and FEIN.

ethanol.

If

the retailer

is a partnership, LLC, S corporation, estate, or trust,

The ethanol percentage used for E85 is 79%, which is an

41-151c (06/19/15)

1

1 2

2 3

3 4

4 5

5