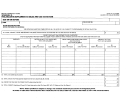

Schedule G-2

Instructions

For definitions of a related member, intangible expenses and costs, intangible interest expenses and costs, and

intangible property see the instructions for Schedule G of the New Jersey CBT-100, CBT-100S or BFC-1 return.

PART I

Exception 1

Exception 4

1.

Complete the enclosed schedule if the taxpayer included any

1.

Complete the enclosed schedule if the taxpayer included any

interest expense on Schedule G, Part I of the CBT-100, CBT-

interest expense on Schedule G, Part I of the CBT-100, CBT-

100S, or BFC-1 return that was directly or indirectly paid,

100S, or BFC-1 return that was directly or indirectly paid,

accrued or incurred to a related member in a foreign nation

accrued or incurred to a independent lender and the

which has in force a comprehensive income tax treaty with

taxpayer filing this return guarantees the debt on which the

the United States.

interest is required.

Exception 2

PART II

1.

Complete the enclosed schedule if the taxpayer included any

interest expense on Schedule G, Part I of the CBT-100, CBT-

Exception 1

100S, or BFC-1 return that was directly or indirectly paid,

1.

Complete the enclosed schedule if the taxpayer included any

accrued or incurred to a related member and for which the

intangible expenses and costs including intangible interest

payment of such interest:

expenses and costs on Schedule G, Part II of the CBT-100,

a) was not to avoid taxes otherwise due under Title 54 of the

CBT-100S, or BFC-1 return that were directly or indirectly

Revised Statutes of Title 54A of the New Jersey Statutes,

paid, accrued or incurred to a related member in a foreign

b) was paid pursuant to arm’s length contracts at an arm’s

nation which has in force a comprehensive income tax treaty

length rate of interest, and

with the United States.

c)

1) The related member was subject to a tax on its net

Exception 2

income or receipts in this State or another state or

1.

Complete the enclosed schedule if the taxpayer included any

possession of the United States or in a foreign nation,

intangible expenses and costs including intangible interest

2) A measure of the tax includes the interest received

expenses and costs on Schedule G, Part II of the CBT-100,

from the related member,

CBT-100S, or BFC-1 return that were directly or indirectly

paid, accrued or incurred to a related member that is a

3) The rate of tax applied to the interest received by the

corporation that files a Corporation Business Tax return in

related member is equal to or greater than a rate three

New Jersey, and such member has included those amounts

percentage points less than the rate of tax applied to

in its entire net income.

taxable interest by this State.

2.

If claiming this exception for more than one related member

A copy of the return from the state, possession or foreign nation

then complete Exception 2 for each related member and

on which the related member reported interest income must be

enter the total for all related members in the Total Exceptions

submitted with the taxpayer’s return.

Chart for Part II.

Exception 3

1.

Complete the enclosed schedule if the taxpayer included any

Notes:

interest expense on Schedule G, Part I of the CBT-100, CBT-

100S, or BFC-1 return that was directly or indirectly paid,

Any other exceptions can not be made on the return.

The

accrued or incurred to a related member that is a corporation

amounts paid to related members as reported on line (a) of

that files a Corporation Business Tax return in New Jersey,

Schedule G, Part I and or Part II, must be included in the amount

and such member included those amounts in its entire net

reported on line (c) of Schedule G, Part I and/or Part II.

income.

2.

If claiming this exception for more than one related member,

A separate Refund Claim (Form A-3730) stipulating all the facts

complete Exception 3 for each related member and enter the

and providing all applicable evidence to support the taxpayer’s

total for all related members in the Total Exceptions Chart for

claim, must be submitted in order to request any other exception.

Part I.

3.

If an exception to the disallowance of the interest expense

was determined under Exception 1 and/or 2, an exception

under this provision for that related member is not available.

1

1 2

2 3

3 4

4 5

5