NAME AS SHOWN ON RETURN

FEDERAL ID NUMBER

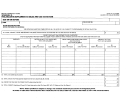

SCHEDULE G-2 PART I

EXCEPTIONS TO THE ADDBACK OF INTEREST

Exception 1 - Amounts Paid, Accrued, or Incurred to a Related Member(s) in a Foreign Nation

1. Was any interest included on Schedule G, Part I of the CBT-100, CBT-100S, or BFC-1 return, directly or indirectly paid, accrued or incurred to a related

member in a foreign nation which has in force a comprehensive income tax treaty with the United States?

“Yes” or “No” _______________________. If “Yes”, complete the following schedule. If “No”, you do not qualify for this exception.

Name of Related Member

Name of Foreign Nation

Description of Treaty

Amount Deducted

(a) Total - enter here and on line 1 of the Total Exceptions Chart for Part I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Exception 2

Interest paid to a related member that was subject to a tax on its net income or receipts in this State or another state or possession of the United States or in

a foreign nation and which jurisdiction includes as a measure of the tax the interest received from the related member and applies a rate of tax to the interest

received by the related member equal to or greater than a rate three percentage points less than the rate of tax applied to taxable interest by this state.

If claiming this exception for more than one related member, complete Exception 2 for each related member and enter the total for all related members in the

Total Exceptions Chart.

Name of Related Member: ______________________________________________________________________________________________________

FID # of Related Member: _______________________________________________________________________________________________________

Fiscal Period of Related Member: ________________________________________________________________________________________________

Name of the state, possession or foreign nation in which the related member is subject to a tax on net income or receipts:_____________________________

Amount of interest income included in the measure of net income or gross receipts subject to tax by the state,

possession or foreign nation: _________________________________________________________________

Column A

Column B

Column C

1. Enter the amount of interest claimed by the taxpayer as

deductible and reported as income or receipts subject to tax by

the related member. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Enter the taxpayer’s allocation factor from line 2, page 1 of the

New Jersey CBT-100, CBT-100S, or BFC-1 return. If non-

allocating, enter 1.00 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Enter the tax rate used to compute from line 9 of the New

Jersey CBT-100 or BFC-1 or line 4 of New Jersey CBT-100S. .

4. Multiply column A, line 2 by column A, line 3 and enter the

result here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Enter the tax rate applied to the net income or receipts from

the return of the related member filed in the state, possession

or foreign nation of the related member on which the interest

income is being reported. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Enter the related member’s allocation factor from the return

filed in the state, possession or foreign nation on which the

interest income is being reported. If non-allocating, enter 1.00.

7. Multiply column A, line 5 by column A, line 6 and enter the

result here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Subtract column B, line 7 from Column B, line 4 and enter

result here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Exception amount-if the amount on column B, line 8 is greater

than .03, enter zero in column C, line 9. If the amount on

column B, line 8 is equal to or less than .03, enter amount from

column C, line 1 in column C, line 9 and on line 2 of the Total

Exceptions Chart for Part I. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A copy of the return from the state, possession or foreign nation on which the related member reported interest income must be submitted with

the taxpayer’s return.

1

1 2

2 3

3 4

4 5

5