Clear Form

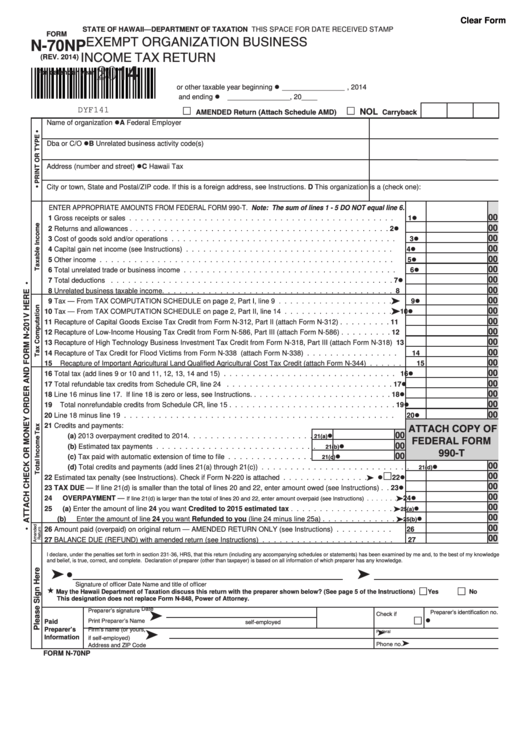

STATE OF HAWAII—DEPARTMENT OF TAXATION

THIS SPACE FOR DATE RECEIVED STAMP

FORM

EXEMPT ORGANIZATION BUSINESS

N-70NP

INCOME TAX RETURN

(REV. 2014)

2014

For calendar year

or other taxable year beginning ________________ , 2014

and ending ________________ , 20____

AMENDED Return (Attach Schedule AMD)

NOL Carryback

DYF141

A Federal Employer I.D. No.

Name of organization

B Unrelated business activity code(s)

Dba or C/O

C Hawaii Tax I.D. No.

Address (number and street)

City or town, State and Postal/ZIP code. If this is a foreign address, see Instructions.

D This organization is a (check one):

Corporation

Charitable Trust

ENTER APPROPRIATE AMOUNTS FROM FEDERAL FORM 990-T. Note: The sum of lines 1 - 5 DO NOT equal line 6.

00

1

Gross receipts or sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2

Returns and allowances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3

Cost of goods sold and/or operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4

Capital gain net income (see Instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5

Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6

Total unrelated trade or business income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7

Total deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8

Unrelated business taxable income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9

Tax — From TAX COMPUTATION SCHEDULE on page 2, Part I, line 9 . . . . . . . . . . . . . . . . . . . .

9

00

10

Tax — From TAX COMPUTATION SCHEDULE on page 2, Part II, line 14 . . . . . . . . . . . . . . . . . . .

10

00

11

Recapture of Capital Goods Excise Tax Credit from Form N-312, Part II (attach Form N-312) . . . . . . . . .

11

00

12

Recapture of Low-Income Housing Tax Credit from Form N-586, Part III (attach Form N-586) . . . . . . . . .

12

00

13

Recapture of High Technology Business Investment Tax Credit from Form N-318, Part III (attach Form N-318)

13

00

14

Recapture of Tax Credit for Flood Victims from Form N-338 (attach Form N-338) . . . . . . . . . . . . . . . .

14

00

15

Recapture of Important Agricultural Land Qualified Agricultural Cost Tax Credit (attach Form N-344) . . . . . .

15

00

16

Total tax (add lines 9 or 10 and 11, 12, 13, 14 and 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

00

17

Total refundable tax credits from Schedule CR, line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

00

18

Line 16 minus line 17. If line 18 is zero or less, see Instructions. . . . . . . . . . . . . . . . . . . . . . . . .

18

00

19

Total nonrefundable credits from Schedule CR, line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

00

20

Line 18 minus line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

ATTACH COPY OF

21

Credits and payments:

21(a)

00

FEDERAL FORM

(a) 2013 overpayment credited to 2014. . . . . . . . . . . . . . . . . . . . . .

21(b)

00

(b) Estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . . . . . .

990-T

21(c)

00

(c) Tax paid with automatic extension of time to file . . . . . . . . . . . . . . .

00

21(d)

(d) Total credits and payments (add lines 21(a) through 21(c)) . . . . . . . . . . . . . . . . . . . . . . . . . .

00

Estimated tax penalty (see Instructions). Check if Form N-220 is attached . . . . . . . . . . . . . . .

22

22

00

23

TAX DUE — If line 21(d) is smaller than the total of lines 20 and 22, enter amount owed (see Instructions) . .

23

00

OVERPAYMENT — If line 21(d) is larger than the total of lines 20 and 22, enter amount overpaid (see Instructions)

24

24

00

(a) Enter the amount of line 24 you want Credited to 2015 estimated tax . . . . . . . . . . . . . . . . . . 25(a)

25

00

(b) Enter the amount of line 24 you want Refunded to you (line 24 minus line 25a) . . . . . . . . . . . . . 25(b)

00

26

Amount paid (overpaid) on original return — AMENDED RETURN ONLY (see Instructions) . . . . . . . . . .

26

00

27

BALANCE DUE (REFUND) with amended return (see Instructions) . . . . . . . . . . . . . . . . . . . . . . .

27

I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements) has been examined by me and, to the best of my knowledge

and belief, is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature of officer

Date

Name and title of officer

May the Hawaii Department of Taxation discuss this return with the preparer shown below? (See page 5 of the Instructions)

Yes

No

This designation does not replace Form N-848, Power of Attorney.

Date

Preparer’s identification no

Preparer’s signature

Check if

Paid

Print Preparer’s Name

self-employed

Preparer’s

Firm’s name (or yours,

Federal

Information

E I No

if self-employed)

Phone no

Address and ZIP Code

FORM N-70NP

1

1 2

2