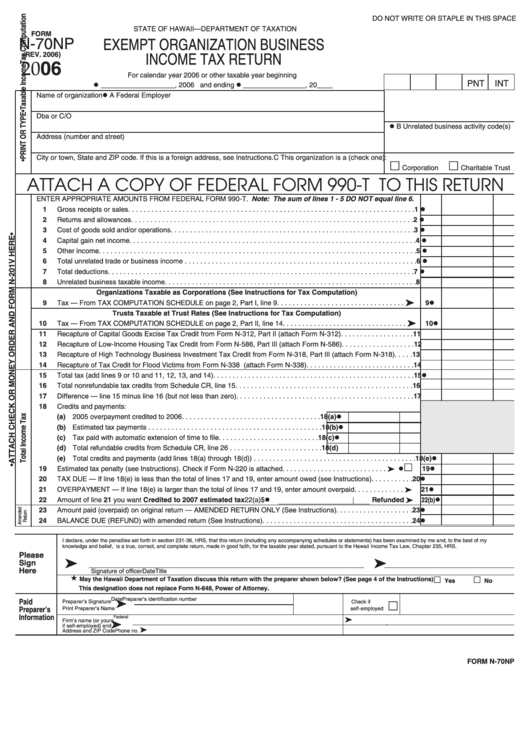

Form N-70np - Exempt Organization Business Income Tax Return - 2006

ADVERTISEMENT

DO NOT WRITE OR STAPLE IN THIS SPACE

STATE OF HAWAII—DEPARTMENT OF TAXATION

FORM

N-70NP

EXEMPT ORGANIZATION BUSINESS

(REV. 2006)

INCOME TAX RETURN

2006

For calendar year 2006 or other taxable year beginning

PNT

INT

l ___________________, 2006 and ending l ________________, 20____

l A Federal Employer I.D. No.

Name of organization

Dba or C/O

l B Unrelated business activity code(s)

Address (number and street)

City or town, State and ZIP code. If this is a foreign address, see Instructions.

C This organization is a (check one):

£

£

Corporation

Charitable Trust

ATTACH A COPY OF FEDERAL FORM 990-T TO THIS RETURN

ENTER APPROPRIATE AMOUNTS FROM FEDERAL FORM 990-T. Note: The sum of lines 1 - 5 DO NOT equal line 6.

1 l

1

Gross receipts or sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 l

2

Returns and allowances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 l

3

Cost of goods sold and/or operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 l

4

Capital gain net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 l

5

Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 l

6

Total unrelated trade or business income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 l

7

Total deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Unrelated business taxable income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Organizations Taxable as Corporations (See Instructions for Tax Computation)

ä

9

Tax — From TAX COMPUTATION SCHEDULE on page 2, Part I, line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9l

Trusts Taxable at Trust Rates (See Instructions for Tax Computation)

ä

10

Tax — From TAX COMPUTATION SCHEDULE on page 2, Part II, line 14. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10l

11

Recapture of Capital Goods Excise Tax Credit from Form N-312, Part II (attach Form N-312) . . . . . . . . . . . . . . . . . . .

11

12

Recapture of Low-Income Housing Tax Credit from Form N-586, Part III (attach Form N-586) . . . . . . . . . . . . . . . . . . .

12

13

Recapture of High Technology Business Investment Tax Credit from Form N-318, Part III (attach Form N-318) . . . . .

13

14

Recapture of Tax Credit for Flood Victims from Form N-338 (attach Form N-338) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15

Total tax (add lines 9 or 10 and 11, 12, 13, and 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15l

16

Total nonrefundable tax credits from Schedule CR, line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17

Difference — line 15 minus line 16 (but not less than zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18

Credits and payments:

(a) 2005 overpayment credited to 2006 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18(a)l

(b) Estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18(b)l

(c) Tax paid with automatic extension of time to file . . . . . . . . . . . . . . . . . . . . . . . . . . 18(c)l

(d) Total refundable credits from Schedule CR, line 26 . . . . . . . . . . . . . . . . . . . . . . . .

18(d)

(e) Total credits and payments (add lines 18(a) through 18(d)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18(e)l

£

Estimated tax penalty (see Instructions). Check if Form N-220 is attached . . . . . . . . . . . . . . . . . . . . . . . . . . . ä l

19

19l

20

TAX DUE — If line 18(e) is less than the total of lines 17 and 19, enter amount owed (see Instructions) . . . . . . . . . . .

20l

OVERPAYMENT — If line 18(e) is larger than the total of lines 17 and 19, enter amount overpaid . . . . . . . . . . . . . ä

21

21l

Refunded ä 22(b)l

22

Amount of line 21 you want Credited to 2007 estimated tax 22(a)$l

23

Amount paid (overpaid) on original return — AMENDED RETURN ONLY (See Instructions) . . . . . . . . . . . . . . . . . . . .

23l

24

BALANCE DUE (REFUND) with amended return (See Instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24l

I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements) has been examined by me and, to the best of my

knowledge and belief, is a true, correct, and complete return, made in good faith, for the taxable year stated, pursuant to the Hawaii Income Tax Law, Chapter 235, HRS.

Please

ä

ä

Sign

Here

Signature of officer

Date

Title

«

£

£

May the Hawaii Department of Taxation discuss this return with the preparer shown below? (See page 4 of the Instructions)

Yes

No

This designation does not replace Form N-848, Power of Attorney.

ä

Date

Preparer’s identification number

Paid

£

Preparer’s Signature

Check if

Preparer’s

Print Preparer’s Name

self-employed

Information

Federal

ä

ä

Firm’s name (or yours

E.I. number

if self-employed) and

‘

ä

Address and ZIP Code

Phone no.

FORM N-70NP

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2