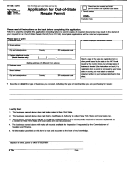

Form St-556 - Instructions For Out-Of-State Lessors Page 2

ADVERTISEMENT

D. Sold to an interstate carrier for hire for use as rolling stock

Line 7a

Check this box if you sold an item for use as rolling stock to haul

We are responsible for collecting and administering the fee on vehicles

persons or commodities for hire in interstate commerce. In the space

imposed by the Metro-East Mass Transit District. You owe this fee if, at

provided, write the certifi cate of authority number. Keep a properly

the end of a lease, you sell a motor vehicle that is located in the Metro-

completed Form RUT-7, Rolling Stock Certifi cation, in your books and

East Mass Transit District portion of St. Clair County. Multiply Line 3 by

records for documentation.

0.5 percent (0.005).

E. Sold for rental use

•

If the result is less than $20, write the result on Line 7a.

Check this box if

•

If the result is $20 or more, write $20 on Line 7a.

•

you sold the vehicle to an Illinois business that is registered to

Line 8

Subtract Line 7 from Line 6. If you wrote an amount on

collect Automobile Renting Tax and

Line 7a (preprinted), subtract Line 7 from Line 6 then add the amount

•

the buyer will use the vehicle for rental purposes in rental

on Line 7a.

agreements of one year or less.

Line 9

If we have notifi ed you that you have an overpayment credit

Write the buyer’s Illinois account ID number.

on your account, you may use this overpayment credit to pay some or

F. Other

all of the tax due on this return. Write the amount you wish to use.

Check this box if the sale is exempt for a reason not identifi ed in boxes

Line 10 In order for us to allow a credit amount that you write on this

A - E.

line, you must meet the requirements described in items 1 through 3

For example: You sold the item to a foreign consul who has a card from

below.

the U.S. Department of State declaring that the foreign consul does

Requirements to claim credit for a previously leased item

not have to pay sales tax on that item. In the space provided, write

1. Use tax was paid either to an Illinois retailer on Form ST-556 or

“Foreign Consul.”

directly to us on Form RUT-25 when the item was purchased.

6 Write the price and fi gure the tax

2. The amount of credit you take on this line is equal to or less than the

Note: When completing this form, please round to the nearest dollar by

amount of tax due on the ST-556 on which you are now reporting the

dropping amounts of less than 50 cents and increasing amounts of 50

retail sale of this previously leased item.

cents or more to the next higher dollar.

3. On the tax return number line, you have written the correct tax

Line 1

Write the total price, including accessories, federal excise

return number either from the

taxes, freight and labor, dealer preparation, documentary fees, and any

•

Form ST-556 fi led by the Illinois retailer when you purchased the

rebates or incentives for which you as a dealer receive reimbursement.

item and paid the tax, or

Do not subtract the value of any rebate made directly to the customer.

•

Form RUT-25 fi led when the item was purchased and the tax paid.

In general, any cost passed on to the customer as part of the sale of

Line 11 If you collected more tax than is due on this sale, write the

an item and for which gross receipts are received should be included

amount you overcollected.

in the total price.

Line 12 Line 8 minus Line 9 minus Line 10 plus Line 11.

Line 2

If you claimed a qualifi ed trade-in (see Section 4), write the

Line 13 If you have a credit memorandum and you wish to use it

total trade-in credit or value. You must identify the traded-in item in the

towards what you owe, write the amount you are using on Line 13.

spaces provided in Section 4.

Line 14 Subtract Line 13 from Line 12, and write the amount due.

If you completed Section 5, skip to “Sign the return.” Otherwise,

Also, write the number of the remittance you are sending to pay the tax

continue reading.

due on this return. If you are fi ling more than one Form ST-556, please

Line 3

Subtract Line 2 from Line 1.

enclose a separate remittance for each return. You owe a late fi ling

Line 4

Multiply Line 3 by your buyer’s tax rate. To fi nd the buyer’s tax

penalty if you do not fi le a processable return by the due date, a late

rate,

payment penalty if you do not pay the amount you owe by the original

•

visit our web site at tax.illinois.gov, or

due date of the return, a bad check penalty if your remittance is not

•

honored by your fi nancial institution, and a cost of collection fee if

call us at 1 800 732-8866 or call our TDD (telecommunications

you do not pay the amount you owe within 30 days of the date printed

device for the deaf) at 1 800 544-5304.

on an assessment. We will bill you for any amounts owed. For more

Also, write the tax rate in the correct space on the form.

information, see Publication 103, Uniform Penalties and Interest. To

Line 5

receive a copy of this publication, visit our web site at tax.illinois.gov or

a. Write the name of the Illinois county in which the buyer’s address

call 1 800 356-6302.

is located.

Sign the return

b. Is the buyer’s address within the limits of an Illinois city or village?

Both the seller and all buyers must sign the return.

If so, write the name of the city or village.

If you claimed a qualifi ed trade-in for the item sold, the signatures also

c. Is the buyer’s address within Madison or St. Clair County? If so,

declare that the title of the traded-in item has been properly assigned

write the name of the township in which the address is located.

and surrendered to the seller.

Do not write a dollar amount on this line.

Line 6

Write the amount from Line 4.

Line 7

If you are fi ling this return within 20 days of the date you

wrote in Section 3, multiply Line 6 by the rate printed on your return.

ST-556(2) back (R-9/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2