Form Ct-1120rc - Research And Experimental Expenditures Tax Credit - 2015

ADVERTISEMENT

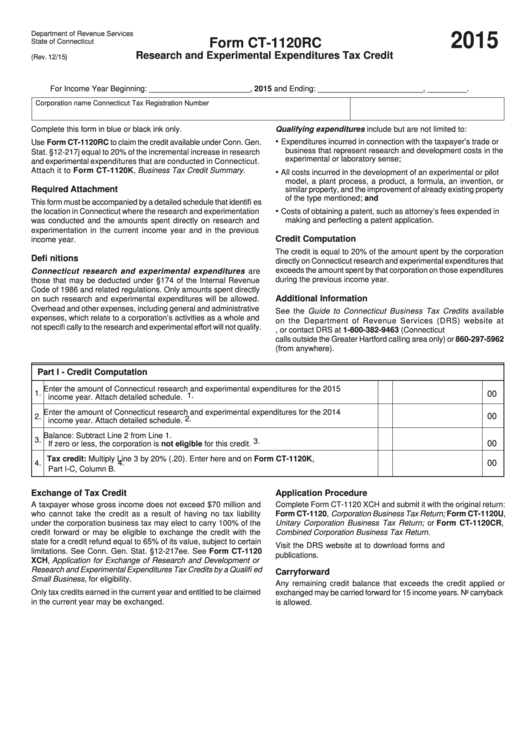

Department of Revenue Services

2015

Form CT-1120RC

State of Connecticut

Research and Experimental Expenditures Tax Credit

(Rev. 12/15 )

For Income Year Beginning: _______________________ , 2015 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Complete this form in blue or black ink only.

Qualifying expenditures include but are not limited to:

•

Expenditures incurred in connection with the taxpayer’s trade or

Use Form CT-1120RC to claim the credit available under Conn. Gen.

business that represent research and development costs in the

Stat. §12-217j equal to 20% of the incremental increase in research

experimental or laboratory sense;

and experimental expenditures that are conducted in Connecticut.

Attach it to Form CT-1120K, Business Tax Credit Summary.

•

All costs incurred in the development of an experimental or pilot

model, a plant process, a product, a formula, an invention, or

Required Attachment

similar property, and the improvement of already existing property

of the type mentioned; and

This form must be accompanied by a detailed schedule that identifi es

•

the location in Connecticut where the research and experimentation

Costs of obtaining a patent, such as attorney’s fees expended in

making and perfecting a patent application.

was conducted and the amounts spent directly on research and

experimentation in the current income year and in the previous

Credit Computation

income year.

The credit is equal to 20% of the amount spent by the corporation

Defi nitions

directly on Connecticut research and experimental expenditures that

exceeds the amount spent by that corporation on those expenditures

Connecticut research and experimental expenditures are

during the previous income year.

those that may be deducted under §174 of the Internal Revenue

Code of 1986 and related regulations. Only amounts spent directly

Additional Information

on such research and experimental expenditures will be allowed.

Overhead and other expenses, including general and administrative

See the Guide to Connecticut Business Tax Credits available

expenses, which relate to a corporation’s activities as a whole and

on the Department of Revenue Services (DRS) website at

not specifi cally to the research and experimental effort will not qualify.

, or contact DRS at 1-800-382-9463 (Connecticut

calls outside the Greater Hartford calling area only) or 860-297-5962

(from anywhere).

Part I - Credit Computation

Enter the amount of Connecticut research and experimental expenditures for the 2015

1.

00

1.

income year. Attach detailed schedule.

Enter the amount of Connecticut research and experimental expenditures for the 2014

2.

00

2.

income year. Attach detailed schedule.

Balance: Subtract Line 2 from Line 1.

3.

3.

00

If zero or less, the corporation is not eligible for this credit.

Tax credit: Multiply Line 3 by 20% (.20). Enter here and on Form CT-1120K,

4.

4.

00

Part I-C, Column B.

Exchange of Tax Credit

Application Procedure

A taxpayer whose gross income does not exceed $70 million and

Complete Form CT-1120 XCH and submit it with the original return:

who cannot take the credit as a result of having no tax liability

Form CT-1120, Corporation Business Tax Return; Form CT-1120U,

under the corporation business tax may elect to carry 100% of the

Unitary Corporation Business Tax Return; or Form CT-1120CR,

credit forward or may be eligible to exchange the credit with the

Combined Corporation Business Tax Return.

state for a credit refund equal to 65% of its value, subject to certain

Visit the DRS website at to download forms and

limitations. See Conn. Gen. Stat. §12-217ee. See Form CT-1120

publications.

XCH, Application for Exchange of Research and Development or

Research and Experimental Expenditures Tax Credits by a Qualifi ed

Carryforward

Small Business, for eligibility.

Any remaining credit balance that exceeds the credit applied or

Only tax credits earned in the current year and entitled to be claimed

exchanged may be carried forward for 15 income years. No carryback

in the current year may be exchanged.

is allowed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2