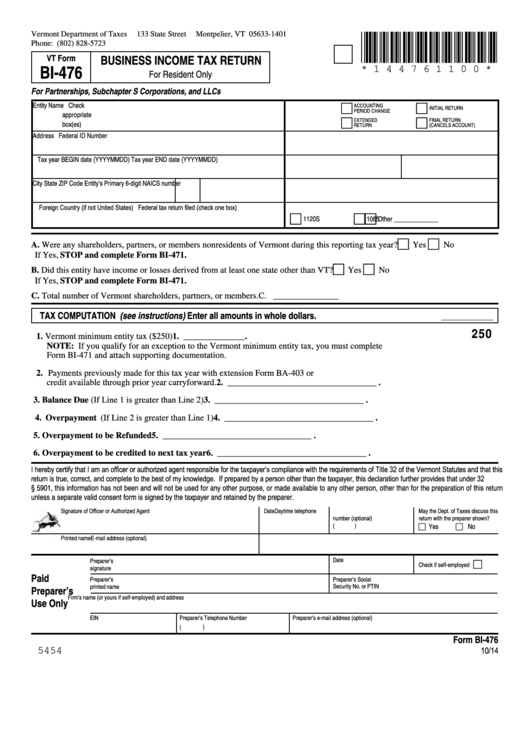

Vt Form Bi-476 - Business Income Tax Return

ADVERTISEMENT

Vermont Department of Taxes

133 State Street

Montpelier, VT 05633-1401

*144761100*

Phone: (802) 828-5723

BUSINESS INCOME TAX RETURN

VT Form

BI-476

* 1 4 4 7 6 1 1 0 0 *

For Resident Only

For Partnerships, Subchapter S Corporations, and LLCs

Entity Name

Check

ACCOUNTING

INITIAL RETURN

PERIOD CHANGE

appropriate

EXTENDED

FINAL RETURN

box(es)

RETURN

(CANCELS ACCOUNT)

Address

Federal ID Number

Tax year BEGIN date (YYYYMMDD)

Tax year END date (YYYYMMDD)

City

State

ZIP Code

Entity’s Primary 6-digit NAICS number

Foreign Country (if not United States)

Federal tax return filed (check one box)

1120S

1065

Other ______________

A. Were any shareholders, partners, or members nonresidents of Vermont during this reporting tax year? . . . . . .

Yes

No

If Yes, STOP and complete Form BI-471.

B. Did this entity have income or losses derived from at least one state other than VT? . . . . . . . . . . . . . . . . . . . .

Yes

No

If Yes, STOP and complete Form BI-471.

C. Total number of Vermont shareholders, partners, or members . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C . _______________

TAX COMPUTATION (see instructions)

Enter all amounts in whole dollars.

250

1. Vermont minimum entity tax ($250) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. ______________ .

NOTE: If you qualify for an exception to the Vermont minimum entity tax, you must complete

Form BI-471 and attach supporting documentation .

2. Payments previously made for this tax year with extension Form BA-403 or

credit available through prior year carryforward . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2. __________________________________ .

3. Balance Due (If Line 1 is greater than Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3. __________________________________ .

4. Overpayment (If Line 2 is greater than Line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4. __________________________________ .

5. Overpayment to be Refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5. __________________________________ .

6. Overpayment to be credited to next tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6. __________________________________ .

I hereby certify that I am an officer or authorized agent responsible for the taxpayer’s compliance with the requirements of Title 32 of the Vermont Statutes and that this

return is true, correct, and complete to the best of my knowledge. If prepared by a person other than the taxpayer, this declaration further provides that under 32 V.S.A.

§ 5901, this information has not been and will not be used for any other purpose, or made available to any other person, other than for the preparation of this return

unless a separate valid consent form is signed by the taxpayer and retained by the preparer.

Signature of Officer or Authorized Agent

Date

Daytime telephone

May the Dept. of Taxes discuss this

number (optional)

return with the preparer shown?

(

)

Yes

No

Printed name

E-mail address (optional)

Date

Preparer’s

Check if self-employed

signature

Paid

Preparer’s

Preparer’s Social

printed name

Security No. or PTIN

Preparer’s

Firm’s name (or yours if self-employed) and address

Use Only

EIN

Preparer’s Telephone Number

Preparer’s e-mail address (optional)

(

)

Form BI-476

10/14

5454

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1