Worksheet For Maine Form 1120me (Schedule B, Line 20) - Modification For Alternative Minimum Tax - 2015

ADVERTISEMENT

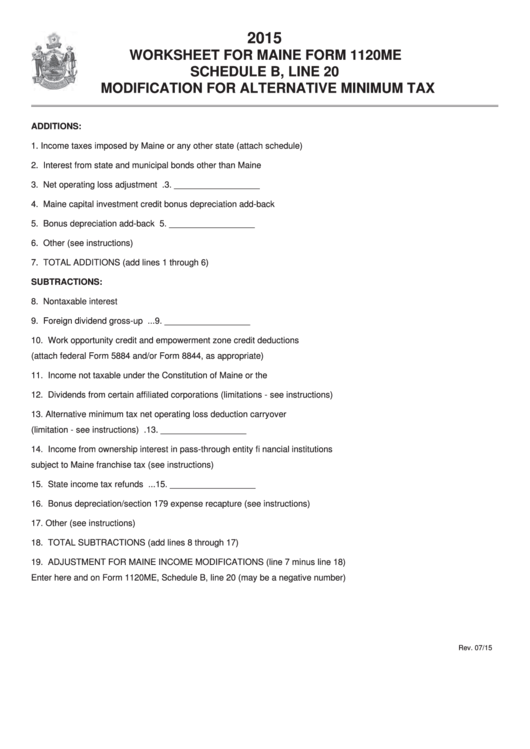

2015

WORKSHEET FOR MAINE FORM 1120ME

SCHEDULE B, LINE 20

MODIFICATION FOR ALTERNATIVE MINIMUM TAX

ADDITIONS:

1.

Income taxes imposed by Maine or any other state (attach schedule) ................................1. __________________

2.

Interest from state and municipal bonds other than Maine ..................................................2. __________________

3.

Net operating loss adjustment ..............................................................................................3. __________________

4.

Maine capital investment credit bonus depreciation add-back .............................................4. __________________

5.

Bonus depreciation add-back ...............................................................................................5. __________________

6.

Other (see instructions) ........................................................................................................6. __________________

7.

TOTAL ADDITIONS (add lines 1 through 6) .........................................................................7. __________________

SUBTRACTIONS:

8.

Nontaxable interest ..............................................................................................................8. __________________

9.

Foreign dividend gross-up ....................................................................................................9. __________________

10.

Work opportunity credit and empowerment zone credit deductions

(attach federal Form 5884 and/or Form 8844, as appropriate) ..........................................10. __________________

11.

Income not taxable under the Constitution of Maine or the U.S. ........................................ 11. __________________

12.

Dividends from certain affi liated corporations (limitations - see instructions) .....................12. __________________

13.

Alternative minimum tax net operating loss deduction carryover

(limitation - see instructions) ...............................................................................................13. __________________

14.

Income from ownership interest in pass-through entity fi nancial institutions

subject to Maine franchise tax (see instructions) ...............................................................14. __________________

15.

State income tax refunds ....................................................................................................15. __________________

16.

Bonus depreciation/section 179 expense recapture (see instructions) ..............................16. __________________

17.

Other (see instructions) ......................................................................................................17. __________________

18.

TOTAL SUBTRACTIONS (add lines 8 through 17) ............................................................18. __________________

19.

ADJUSTMENT FOR MAINE INCOME MODIFICATIONS (line 7 minus line 18)

Enter here and on Form 1120ME, Schedule B, line 20 (may be a negative number) ........19. __________________

Rev. 07/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3