Form 3540 - California Credit Carryover And Recapture Summary - 2014

ADVERTISEMENT

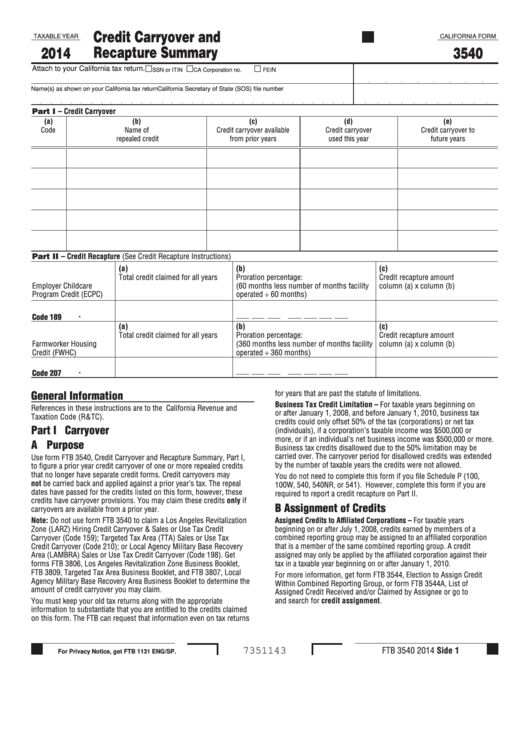

Credit Carryover and

TAXABLE YEAR

CALIFORNIA FORM

Recapture Summary

2014

3540

Attach to your California tax return.

N

SSN or ITIN

CA Corporation no.

FEI

Name(s) as shown on your California tax return

California Secretary of State (SOS) file number

v

Part I – Credit Carryover

(a)

(b)

(c)

(d)

(e)

Code

Name of

Credit carryover available

Credit carryover

Credit carryover to

repealed credit

from prior years

used this year

future years

Part II – Credit Recapture (See Credit Recapture Instructions)

(a)

(b)

(c)

Total credit claimed for all years

Proration percentage:

Credit recapture amount

Employer Childcare

(60 months less number of months facility

column (a) x column (b)

Program Credit (ECPC)

operated ÷ 60 months)

.

Code 189

(a)

(b)

(c)

Total credit claimed for all years

Proration percentage:

Credit recapture amount

Farmworker Housing

(360 months less number of months facility

column (a) x column (b)

Credit (FWHC)

operated ÷ 360 months)

.

Code 207

for years that are past the statute of limitations.

General Information

Business Tax Credit Limitation – For taxable years beginning on

References in these instructions are to the California Revenue and

or after January 1, 2008, and before January 1, 2010, business tax

Taxation Code (R&TC).

credits could only offset 50% of the tax (corporations) or net tax

Part I Carryover

(individuals), if a corporation’s taxable income was $500,000 or

more, or if an individual’s net business income was $500,000 or more.

A Purpose

Business tax credits disallowed due to the 50% limitation may be

carried over. The carryover period for disallowed credits was extended

Use form FTB 3540, Credit Carryover and Recapture Summary, Part I,

by the number of taxable years the credits were not allowed.

to figure a prior year credit carryover of one or more repealed credits

that no longer have separate credit forms. Credit carryovers may

You do not need to complete this form if you file Schedule P (100,

not be carried back and applied against a prior year’s tax. The repeal

100W, 540, 540NR, or 541). However, complete this form if you are

dates have passed for the credits listed on this form, however, these

required to report a credit recapture on Part II.

credits have carryover provisions. You may claim these credits only if

B Assignment of Credits

carryovers are available from a prior year.

Note: Do not use form FTB 3540 to claim a Los Angeles Revitalization

Assigned Credits to Affiliated Corporations – For taxable years

beginning on or after July 1, 2008, credits earned by members of a

Zone (LARZ) Hiring Credit Carryover & Sales or Use Tax Credit

combined reporting group may be assigned to an affiliated corporation

Carryover (Code 159); Targeted Tax Area (TTA) Sales or Use Tax

Credit Carryover (Code 210); or Local Agency Military Base Recovery

that is a member of the same combined reporting group. A credit

Area (LAMBRA) Sales or Use Tax Credit Carryover (Code 198). Get

assigned may only be applied by the affiliated corporation against their

tax in a taxable year beginning on or after January 1, 2010.

forms FTB 3806, Los Angeles Revitalization Zone Business Booklet,

FTB 3809, Targeted Tax Area Business Booklet, and FTB 3807, Local

For more information, get form FTB 3544, Election to Assign Credit

Agency Military Base Recovery Area Business Booklet to determine the

Within Combined Reporting Group, or form FTB 3544A, List of

amount of credit carryover you may claim.

Assigned Credit Received and/or Claimed by Assignee or go to

ftb.ca.gov and search for credit assignment.

You must keep your old tax returns along with the appropriate

information to substantiate that you are entitled to the credits claimed

on this form. The FTB can request that information even on tax returns

FTB 3540 2014 Side 1

7351143

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4