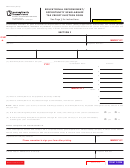

REV-1186 (01-13)

SALES, USE & HOTEL OCCUPANCY TAX SCHEDULE

Taxpayers must identify sales, use and hotel occupancy tax remitted in the form of a payment to the

Department of Revenue, which was collected:

(1) At all business locations within Pennsylvania; and

(2) At the business location(s) within the NIZ.

Businesses with locations inside and outside the NIZ must apportion tax type attributable to the location(s)

within the NIZ.

Businesses are encouraged to consult PA-3 sales tax filing histories and e-TIDES account information to

determine sales, use and hotel occupancy tax paid to the commonwealth and refunded during each quarter of

the calendar year.

NOTE: Construction contractors should not include sales tax paid on materials used in construction within

the NIZ. Instead, construction contractors should report these amounts on the Construction

Contractor Tax Report: Form number 1193.

Tax Payments

A) All Pennsylvania Locations

$

Total tax remitted in the form of a payment, received by the department for

consolidated sales, use and hotel occupancy.

B) NIZ Location

$

Total sales, use and hotel occupancy tax attributable to the location within the NIZ.

Tax Refunds

C) All Pennsylvania Locations

$

Refunds granted to the Consolidated Sales, Use and Hotel Occupancy Account.

D) NIZ Location

$

Refunds granted attributable to the location within the NIZ for sales, use and

hotel occupancy taxes.

Tax Payment Apportionment Factor

Please provide the percentage of sales, use and hotel occupancy taxes attributable to the location within the NIZ:

%.

Page 5

PRINT

NEXT PAGE

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9