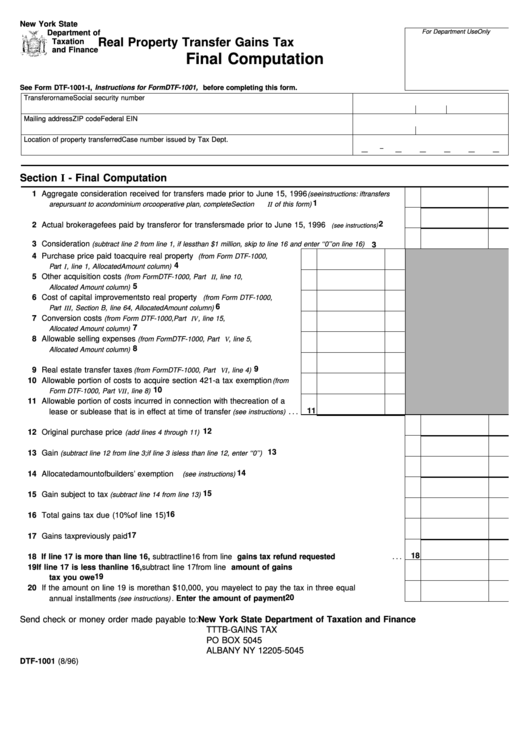

Form Dtf-1001 - Real Property Transfer Gains Tax Final Computation

ADVERTISEMENT

New York State

For Department Use Only

Department of

Real Property Transfer Gains Tax

Taxation

and Finance

Final Computation

See Form DTF-1001-I, Instructions for Form DTF-1001, before completing this form.

Transferor name

Social security number

Mailing address

ZIP code

Federal EIN

Location of property transferred

Case number issued by Tax Dept.

–

—

—

—

—

—

—

Section I - Final Computation

1 Aggregate consideration received for transfers made prior to June 15, 1996

(see instructions: if transfers

1

are pursuant to a condominium or cooperative plan, complete Section II of this form)

. . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Actual brokerage fees paid by transferor for transfers made prior to June 15, 1996

. . . . . . . .

(see instructions)

3 Consideration

. . . . . . . . .

(subtract line 2 from line 1, if less than $1 million, skip to line 16 and enter ‘‘0’’ on line 16)

3

4 Purchase price paid to acquire real property

(from Form DTF-1000,

4

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part I , line 1, Allocated Amount column)

5 Other acquisition costs

(from Form DTF-1000, Part II , line 10,

5

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Allocated Amount column)

6 Cost of capital improvements to real property

(from Form DTF-1000,

6

. . . . . . . . . . . . . . . . . . . . . . . .

Part III , Section B, line 64, Allocated Amount column)

7 Conversion costs

(from Form DTF-1000, Part IV , line 15,

7

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Allocated Amount column)

8 Allowable selling expenses

(from Form DTF-1000, Part V , line 5,

8

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Allocated Amount column)

9

9 Real estate transfer taxes

. . . . . . . . . . . . .

(from Form DTF-1000, Part VI , line 4)

10 Allowable portion of costs to acquire section 421-a tax exemption

(from

10

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Form DTF-1000, Part VII , line 8)

11 Allowable portion of costs incurred in connection with the creation of a

11

lease or sublease that is in effect at time of transfer

. . .

(see instructions)

12

12 Original purchase price

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(add lines 4 through 11)

13

13 Gain

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(subtract line 12 from line 3; if line 3 is less than line 12, enter ‘‘0’’)

14

14 Allocated amount of builders’ exemption

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(see instructions)

15

15 Gain subject to tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(subtract line 14 from line 13)

16

16 Total gains tax due (10% of line 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

17 Gains tax previously paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

18 If line 17 is more than line 16, subtract line 16 from line 17. This is the gains tax refund requested . . .

19 If line 17 is less than line 16, subtract line 17 from line 16. This is the amount of gains

19

tax you owe . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20 If the amount on line 19 is more than $10,000, you may elect to pay the tax in three equal

20

annual installments

Enter the amount of payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(see instructions) .

Send check or money order made payable to: New York State Department of Taxation and Finance

TTTB-GAINS TAX

PO BOX 5045

ALBANY NY 12205-5045

DTF-1001 (8/96)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2