Important information:

To comply with federal law Title 15 U.S. Code § 376, the Jenkins Act as amended by S. 1147, the Pact Act, any person who

(1) sells, transfers or ships for profit cigarettes - including roll-your-own and smokeless tobacco - into a state; or (2) who advertises

or offers cigarettes - including roll-your-own and smokeless tobacco - for such sale, transfer or shipment, is required to:

1. Register with the Pennsylvania Department of Revenue, providing name and trade name; address of principle place of

business and of any other place of business; telephone numbers for each place of business; principal electronic mail

address; any Web addresses; and the name, address and phone number of any agent in the state authorized to accept

service on behalf of the business. Send to the Pennsylvania Department of Revenue a copy of your Pact Act

registration form filed with the U.S. Attorney General, to meet this registration requirement. The form is

available at

2. File the Cigarette Sales Report and Tobacco Sales Report by the 10th day of each month for the previous month’s

shipments.

Send your registration and reports electronically to ra-btftmisctax@pa.gov or mail to PA Department of Revenue,

Miscellaneous Tax Division, PO Box 280909, Harrisburg, PA 17128-0909.

To comply with Pennsylvania law, Pennsylvania cigarette dealers are required to:

1. Be licensed with the department to sell cigarettes, 72 P.S. § 228-A.

2. Comply with the state minimum price regulations, 72 P.S. § 217-A.

3. Only ship Pennsylvania stamped cigarettes to Pennsylvania addresses, 72 P.S. § 8273.

4. Collect the applicable cigarette and sales taxes and remit them to the department, 72 P.S. § 8272(b) and

72 P.S. § 7268(b).

5. Not sell any “gray market” cigarettes, 72 P.S. § 217.1-A.

6. Sell only cigarettes listed on the PA Attorney General’s website pursuant to the Act 64 Tobacco Product Manufacturer

Directory Act and Cigarette Fire Safety & Fire Fighter Protection Act, 35 P.S. § 5702.101-311.

7. Comply with the Internet Sales Regulation 72 P.S. § 231A.

To contact the PA Department of Revenue by phone, call 717-783-9374.

Instructions

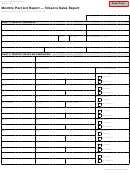

Step 1: Identify your business

License number - Write the sales tax license number issued to you by Pennsylvania. Leave the box blank if you do not have a

Pennsylvania sales tax license number.

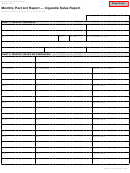

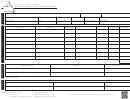

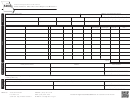

Step 2: Identify your sales

FEIN or License # - Write the buyer’s Federal Employer Identification Number (FEIN) or Federal Tax Identification Number

(FTIN). If the buyer does not have either of these numbers, write the buyer's state sales tax license number. If you are making a

delivery sale to a consumer, leave the box blank.

UPC - Write the Universal Product Code for each product brand.

Type - Write the number for each type of tobacco product you are reporting.

1 = Snuff

2 = Chew

3 = Pipe Tobacco

4 = Cigars

5 = Roll your own cigarettes

6 = Other

Deliverer name, address and phone - Complete only for delivery sales and provide the information of the person who delivered

the tobacco for you.

Step 3: Sign below

Sign the bottom of the form.

PRINT FORM

RETURN TO TOP

RETURN TO PAGE ONE

1

1 2

2