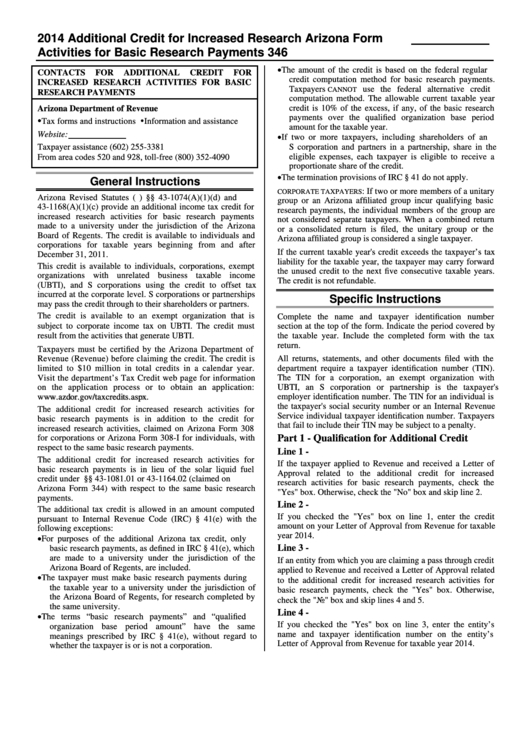

Form 346 - Arizona Additional Credit For Increased Research Activities For Basic Research Payments - 2014

ADVERTISEMENT

2014 Additional Credit for Increased Research

Arizona Form

Activities for Basic Research Payments

346

The amount of the credit is based on the federal regular

CONTACTS

FOR

ADDITIONAL

CREDIT

FOR

credit computation method for basic research payments.

INCREASED RESEARCH ACTIVITIES FOR BASIC

Taxpayers

use the federal alternative credit

CANNOT

RESEARCH PAYMENTS

computation method. The allowable current taxable year

credit is 10% of the excess, if any, of the basic research

Arizona Department of Revenue

payments over the qualified organization base period

Tax forms and instructions Information and assistance

amount for the taxable year.

Website:

If two or more taxpayers, including shareholders of an

Taxpayer assistance

(602) 255-3381

S corporation and partners in a partnership, share in the

eligible expenses, each taxpayer is eligible to receive a

From area codes 520 and 928, toll-free

(800) 352-4090

proportionate share of the credit.

The termination provisions of IRC § 41 do not apply.

General Instructions

: If two or more members of a unitary

CORPORATE TAXPAYERS

Arizona Revised Statutes (A.R.S.) §§ 43-1074(A)(1)(d) and

group or an Arizona affiliated group incur qualifying basic

43-1168(A)(1)(c) provide an additional income tax credit for

research payments, the individual members of the group are

increased research activities for basic research payments

not considered separate taxpayers. When a combined return

made to a university under the jurisdiction of the Arizona

or a consolidated return is filed, the unitary group or the

Board of Regents. The credit is available to individuals and

Arizona affiliated group is considered a single taxpayer.

corporations for taxable years beginning from and after

If the current taxable year's credit exceeds the taxpayer’s tax

December 31, 2011.

liability for the taxable year, the taxpayer may carry forward

This credit is available to individuals, corporations, exempt

the unused credit to the next five consecutive taxable years.

organizations with unrelated business taxable income

The credit is not refundable.

(UBTI), and S corporations using the credit to offset tax

incurred at the corporate level. S corporations or partnerships

Specific Instructions

may pass the credit through to their shareholders or partners.

The credit is available to an exempt organization that is

Complete the name and taxpayer identification number

subject to corporate income tax on UBTI. The credit must

section at the top of the form. Indicate the period covered by

result from the activities that generate UBTI.

the taxable year. Include the completed form with the tax

return.

Taxpayers must be certified by the Arizona Department of

Revenue (Revenue) before claiming the credit. The credit is

All returns, statements, and other documents filed with the

limited to $10 million in total credits in a calendar year.

department require a taxpayer identification number (TIN).

Visit the department’s Tax Credit web page for information

The TIN for a corporation, an exempt organization with

on the application process or to obtain an application:

UBTI, an S corporation or partnership is the taxpayer's

w

w

w

.

a

z

d

o

r

.

g

o

v

/

t

a

x

c

r

e

d

i

t

s

.

a

s

p

x .

employer identification number. The TIN for an individual is

w

w

w

.

a

z

d

o

r

.

g

o

v

/

t

a

x

c

r

e

d

i

t

s

.

a

s

p

x

the taxpayer's social security number or an Internal Revenue

The additional credit for increased research activities for

Service individual taxpayer identification number. Taxpayers

basic research payments is in addition to the credit for

that fail to include their TIN may be subject to a penalty.

increased research activities, claimed on Arizona Form 308

Part 1 - Qualification for Additional Credit

for corporations or Arizona Form 308-I for individuals, with

respect to the same basic research payments.

Line 1 -

The additional credit for increased research activities for

If the taxpayer applied to Revenue and received a Letter of

basic research payments is in lieu of the solar liquid fuel

Approval related to the additional credit for increased

credit under A.R.S. §§ 43-1081.01 or 43-1164.02 (claimed on

research activities for basic research payments, check the

Arizona Form 344) with respect to the same basic research

"Yes" box. Otherwise, check the "No" box and skip line 2.

payments.

Line 2 -

The additional tax credit is allowed in an amount computed

If you checked the "Yes" box on line 1, enter the credit

pursuant to Internal Revenue Code (IRC) § 41(e) with the

amount on your Letter of Approval from Revenue for taxable

following exceptions:

year 2014.

For purposes of the additional Arizona tax credit, only

Line 3 -

basic research payments, as defined in IRC § 41(e), which

are made to a university under the jurisdiction of the

If an entity from which you are claiming a pass through credit

Arizona Board of Regents, are included.

applied to Revenue and received a Letter of Approval related

The taxpayer must make basic research payments during

to the additional credit for increased research activities for

the taxable year to a university under the jurisdiction of

basic research payments, check the "Yes" box. Otherwise,

the Arizona Board of Regents, for research completed by

check the "No" box and skip lines 4 and 5.

the same university.

Line 4 -

The terms “basic research payments” and “qualified

If you checked the "Yes" box on line 3, enter the entity’s

organization base period amount” have the same

name and taxpayer identification number on the entity’s

meanings prescribed by IRC § 41(e), without regard to

Letter of Approval from Revenue for taxable year 2014.

whether the taxpayer is or is not a corporation.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2